- EUR/USD is in a three-day uptrend, bringing orders to yesterday’s intraday high.

- The dollar’s bulls cannot be turned back by market decisions. Federal language is not aggressive.

- Since August, the biggest daily jump was not halted by German inflation and Eurozone GDP in the fourth quarter.

The EUR/USD price reached intraday highs near 1.1240 ahead of Tuesday’s European session in a three-day uptrend. In the meantime, the major currency pair welcomes broader US dollar weakness amid inactive markets ahead of the US ISM Manufacturing PMI release for January.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

On the day, the US Dollar Index (DXY) fell 0.09% to 96.55 after posting its biggest one-day loss in a month. Fed leadership’s reluctance to support the rate hike path despite inflation concerns likely helped Dollar bears. Fed speakers included Atlanta Fed President Rafael Bostic, Kansas City Fed President Esther George, and San Francisco Federal Reserve Bank President Mary Daly.

A recent comment by OECD Secretary-General Matthias Kormann suggests a decline in global inflation over the next two years as central banks normalize monetary policy stances appears to have also favored EUR/USD bulls.

Reuters reports that the US is sending additional troops over 8,500 to Eastern Europe, challenging market sentiment. However, the latest news indicates that Russian-Ukrainian fighting is easing, citing a written report from Moscow to the US.

Earlier this week, the German harmonized index of consumer prices rose to 5.1% on an annualized basis from a forecast of 4.7%. In comparison, preliminary GDP data for the Eurozone for the fourth quarter came in at 4.47% on an annualized basis from 4.6%.

Traders will be watching German retail sales data for December, which is expected to come in at -0.6%y/y compared to -2.9% previously, ahead of the release of the manufacturing PMI in December by ISM, which is forecast to be 57.5 versus 58.7 earlier on Jan. 1, for the immediate direction. First, however, the focus is on the Fed’s statements and developments concerning Russia.

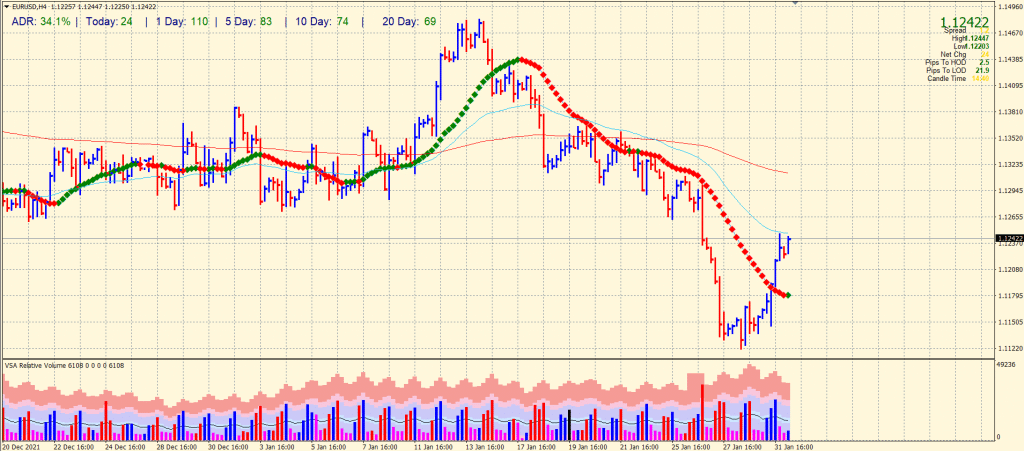

EUR/USD price technical analysis: Bulls capped by 1.1250

The EUR/USD price managed to break the 1.1200 mark yesterday. However, the pair lacks strong follow-through momentum near the 1.1250 level. Moreover, the 50-period SMA sits around the same level, providing some resistance. Further on the upside, we can find stiff resistance around the 1.1300 area.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

On the flip side, 1.1200 will be the key support ahead of 1.1120. Meanwhile, the bears have eyes on the ultimate target of 1.1000.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.