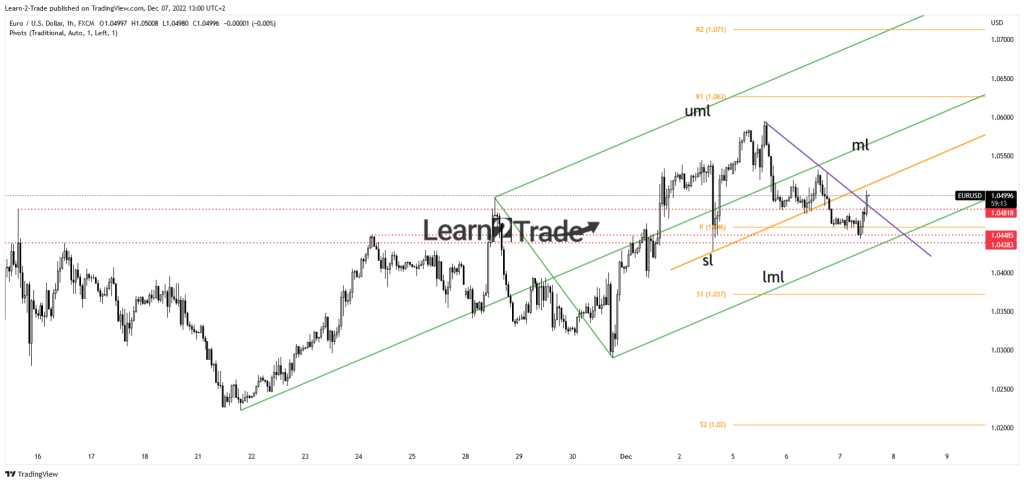

- The bias remains bullish as long as it stays within the ascending pitchfork’s body.

- A new higher high activates further growth.

- Taking out the lower median line (LML) announces a deeper drop.

The EUR/USD price dropped as low as 1.0443 today. Now the pair has turned to the upside. It was trading at 1.0495 at the time of writing.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

The bias remains bullish in the short term despite temporary retreats. The greenback extended its sell-off as the Federal Reserve is expected to deliver a 50 bps hike in December.

The USD appreciated a little only after the US ISM Services PMI, Factory Orders, and Final Services PMI came in better than expected on Monday.

Yesterday, the US Trade Balance came in at -78.2B compared to -80.1B expected but below -74.1B in the previous reporting period. On the other hand, the German Factory Orders rose by 0.8%, beating the 0.2% growth forecasted.

Today, the Euro received a helping hand again. The Eurozone Revised surged by 0.3% exceeding the 0.2% growth expected. Final Employment Change reported a 0.3% growth versus the 0.2% growth estimated, while German Industrial Production dropped only by 0.1%, less than the 0.6% drop forecasted.

Later, the BoC is seen as a high-impact event and could bring action to the EUR/USD pair. The US Revised Nonfarm Productivity and Revised Unit Labor Costs will also be released.

EUR/USD price technical analysis: Upside momentum

Technically, the EUR/USD pair rebounded after finding support in the 1.0438 – 1.0448 area. Now, the pair has passed above the immediate descending trendline and almost reached the inside sliding line (SL), representing an upside obstacle. Still, as long as it stays within the ascending pitchfork’s body. Only dropping below this line and through 1.0438 activates more declines.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

In the short term, the pair may remain sideways. An upside continuation could be triggered after coming back and stabilizing above the median line (ML). A new high may open the door for more gains ahead.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.