- The EUR/USD exchange rate accepts offers to schedule a two-day recovery on news that Ukraine violated the ceasefire.

- The ECB’s policy has become more hawkish lately, with the FOMC declining to support a 0.5% rate hike in March.

- In response to strong US data, yields fell, but the DXY rebounded on a fresh wave of risk aversion.

While the greenback welcomes a surprise risk-off shift in Europe early Thursday, the EUR/USD price remains under pressure near 1.1350 as the pair retreats from a weekly high.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

In contrast, the US Dollar Index (DXY) reversed after a three-day downtrend, posting a large one-day gain near 96.00 after Sputnik reported that Ukraine violated ceasefire in four LNR settlements. Russian forces had earlier withdrawn from the border, but news from the West, Ukraine, and Estonia cast doubt on Moscow’s actions.

Equity futures are lower, and US Treasury yields are falling, while traditional safe-haven assets like gold benefit from a desire to protect against risk.

In previous minutes, FOMC members voiced hawkish views but did not appear to strongly favor raising rates by 0.50% in March. This could be due to a preliminary inflation analysis. Reuters reported that Federal Reserve officials concurred last month that monetary policy needed to be tightened but would analyze data for each meeting before making decisions.

As for Martins Kazaks, a member of the European Central Bank’s Board of Governors and the governor of the Central Bank of Latvia, he said it was “quite likely” that rates would rise this year. The policymaker, however, recommends a cautious, gradual policy adjustment and says money market rates, which make a first ECB rate hike unlikely by the end of 2022, are a little too harsh.

ECB’s economic bulletin, which is published eight times a year, will test the recent positive rhetoric from ECB officials today. Philip Lane, the ECB’s chief economist, will also need to be heard.

According to US data, retail sales and industrial production increased sharply in January compared to previous months and market expectations. The numbers rose by 3.8% and 1.4%, respectively. In addition to raising the prospects of a Fed rate hike, this underscores the disappointment that policymakers have been holding back.

Moving forward, we will see second-tier data on US economics, such as housing data, unemployment claims, and the Philadelphia Fed manufacturing survey. Nevertheless, the focus will be on Fedspeak and updates from the G20 and news from Russia and Ukraine to set a clear direction.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

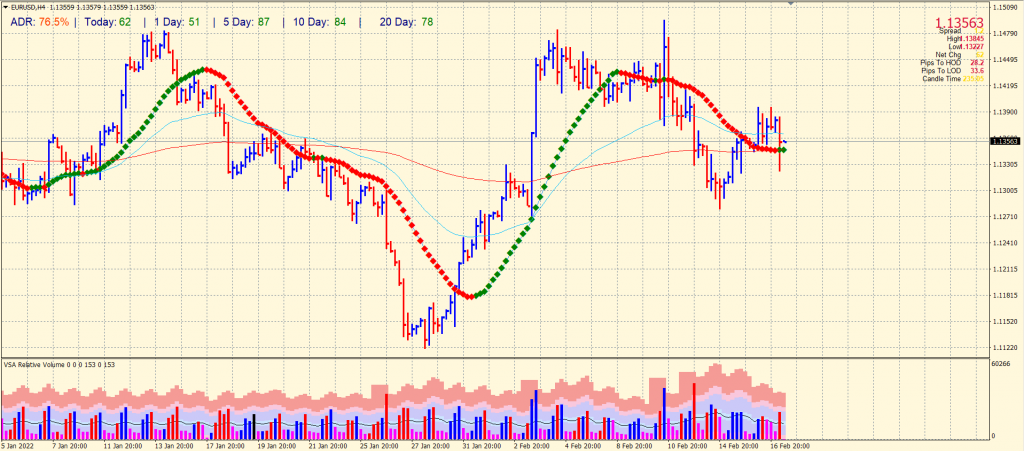

EUR/USD price technical analysis: Bulls find no respite

The EUR/USD price dipped below the key moving averages on the 4-hour chart. However, the pair managed to reverse losses and is wobbling above the mid-1.1300 area. The volume for the recent bar is too high, but the bar’s close will decide fate. Overall, the pair is expected to stay rangebound from 1.1300 to 1.1400.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money