- The EUR/USD falls to new lows around 1.1390.

- After recent highs near 1.1490, the pair remains under pressure.

- German ZEW poll is the next important event on the domestic calendar.

It’s been a tough week for the euro, as the EUR/USD price has dropped to multi-day lows in the 1.1390 range on Tuesday. EUR/USD’s downside momentum accelerates below 1.1400 as the US Dollar rallies, helping the US Dollar Index (DXY) rebound from recent lows.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

Earlier this month, the EUR/USD pair made new highs around 1.1480. Meanwhile, policy divergences between the Fed and ECB and yields will continue to drive price action around the pair for now. ECB officials have been quite vocal lately, admitting the euro area’s high inflation may continue for a longer period, fueling new speculation about the central bank’s rate hike in late 2022. As for the coronavirus pandemic, it remains an exceptionally important factor to consider when evaluating the region’s economic growth prospects and investor sentiment.

Growing speculation that the Fed will raise federal funds target range once it meets in March boosts dollar demand and dampens risk sentiment. However, market participants expect the EcoFin meeting to have little impact on the currency area, where the European recovery fund is likely to dominate the discussion.

Investors are awaiting the release of Germany and Europe’s economic sentiment data for January, which is tracked by the ZEW survey. In Germany, December car registrations were up 14.8% month-on-month at the start of the session. The NA session will also include presentations on Across the Ocean, NY Empire State Index, NAHB Index, and TIC Flows.

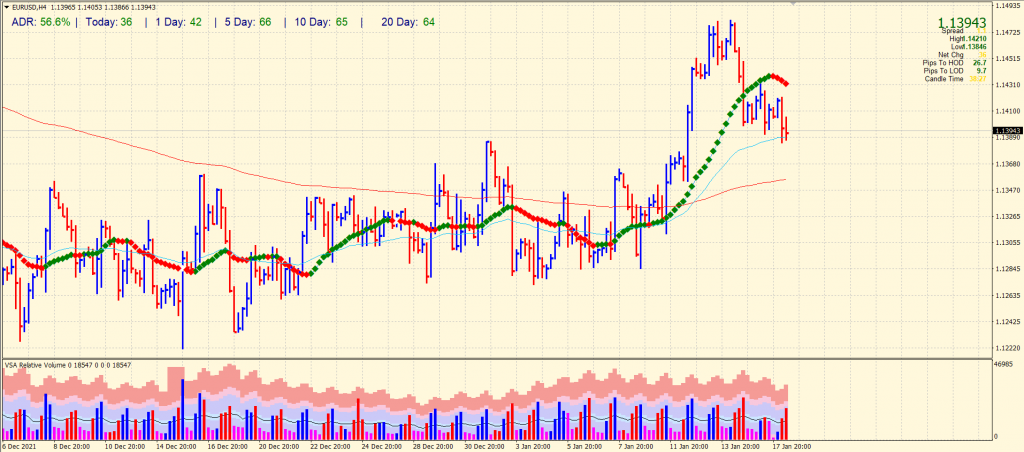

EUR/USD price technical outlook: Bears pause at 50-SMA

The EUR/USD price outlook seems negative as the pair stays far below the top of 1.1490 and recently broke below the 20-period SMA on the 4-hour chart as well. However, the price finds respite from the 50-period SMA and tries to gain acceptance above 1.1400.

–Are you interested to learn more about forex brokers? Check our detailed guide-

If the price stays below the 1.1400 handle, we may see a further decline to 1.1330 ahead of 1.1300. Alternatively, sustaining above 1.1400 may push the prices higher towards 1.1450 and 1.1490.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.