- EUR/USD looks to add to Tuesday’s gains above 1.2100.

- German/EMU final February Services PMI remain depressed.

- ECB-speak, US ADP report and ISM Non-Manufacturing next on tap.

The European currency manages to leave behind the recent weakness and pushes EUR/USD back to the proximity of the 1.2100 neighbourhood on Wednesday.

EUR/USD retakes 1.2100 on ECB

EUR/USD advances further and clinch the area just above 1.2100 the figure on Wednesday, extending the bounce off Tuesday’s lows in the 1.1990 zone.

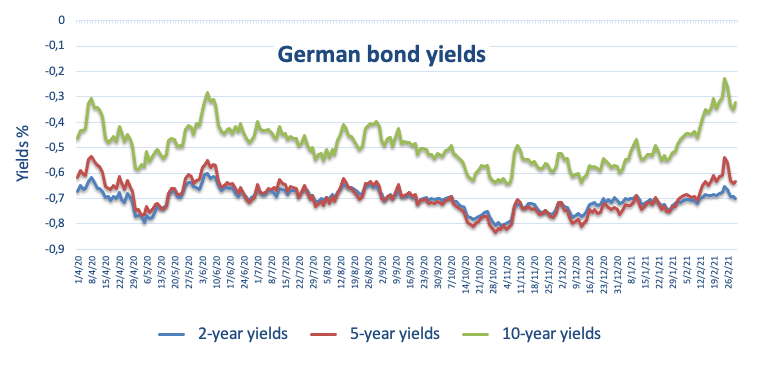

The rebound in the pair comes in tandem with rising European yields, all after the ECB said there is no need to implement a drastic action to curb bond yields in the Old Continent.

Looking at the macro scenario, the vaccine/reflation trade keeps dominating the investors’ sentiment along with prospects of a solid bounce in the economic activity in the region in HS 2021.

Earlier in the euro docket, final Services PMIs in Germany and Euroland showed mixed results although both remain still in the contraction territory (<50). Later in the session, EMU’s Producer Prices are due seconded by speeches by ECB’s Board members F.Panetta, L. De Guindos and I.Schnabel.

Across the pond, the ADP report and the ISM Non-Manufacturing will be in the limelight along with speeches by FOMC’s Harker, Bostic and Evans.

What to look for around EUR

EUR/USD bounces off recent sub-1.2000 lows and trades back in the 1.2100 neighbourhood. The underlying bullish sentiment in the euro remains under pressure for the time being amidst investors’ adjustment to potential US inflation and the subsequent increase in yields and the demand for the dollar. Looking at the medium/longer-run, the outlook for the pair remains constructive on the back of prospects of extra fiscal stimulus in the US, real interest rates favouring Europe vs. the US and hopes of a solid economic rebound in the next months.

Key events in Euroland this week: EMU’s Retail Sales, Unemployment Rate (Thursday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always amidst the current (and future) context of subdued inflation. Potential political effervescence around the EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is gaining 0.10% at 1.2102 and a breakout of 1.2139 (50-day SMA) would target 1.2243 (weekly high Dec.17) en route to 1.2349 (2021 high Jan.6). On the flip side, the next up barrier comes in at 1.1991 (weekly low Mar.2) followed by 1.1976 (50% Fibo of the November-January rally) and finally 1.1952 (2021 low Feb.5).