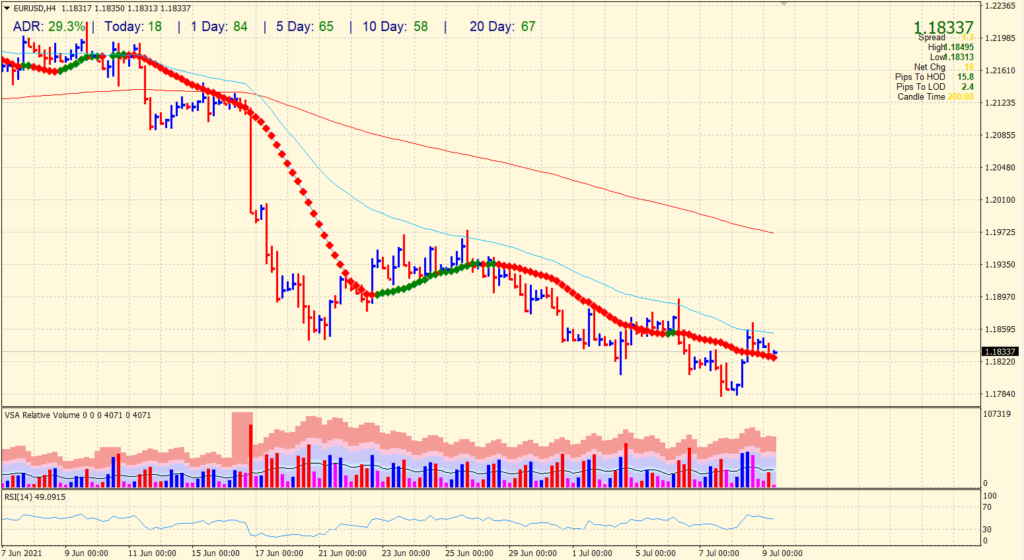

- EUR/USD managed to recover from under 1.1800 area.

- The pair posted gains but couldn’t hold above 50-SMA on the 4-hour chart.

- The forecast for the pair is still to the downside.

The EUR/USD currency pair on Thursday, July 8, continued to trade very calmly, maintaining a downtrend. A day earlier, the bears managed to lower the pair to the level of 1.1780 but failed to overcome it.

An upward rebound followed, and a new round of correction started. Even though the pair continues to decline in the last two weeks, during this time, it has lost only 150-160 points. All in all, within the framework of the last round of the global correction, almost 500 points were lost in a month and a half.

Much of that distance, of course, was bridged in the days that the Fed took stock of its last meeting. Thus, it turns out that in the last month and a half, the EUR/USD pair has simply been corrected and may complete this correction at any time.

The European currency is winning back losses against the dollar after three trading sessions of decline. Today, market participants drew attention to the decision of the Board of Governors of the European Central Bank to raise the medium-term inflation target for monetary policy to 2%. Previously, the inflation target for the regulator was below 2%.

The dynamics of the EUR/USD pair was influenced by reports from Germany. The volume of exports in May increased by 0.3% against the forecast of 0.6%. On the other hand, the volume of imports increased by 3.4% after falling by 1.4% in April; experts expected an increase of 0.4%.

ECB’s Lagarde has to deliver a speech today. The markets can find fresh impetus from the event.

EUR/USD technical forecast: Downtrend to continue

The EUR/USD currency pair is paring off yesterday’s gains. The day before, the Euro fell below 1.18 for the first time since the beginning of April. The relative strength indicator on the four-hour chart is recovering to the neutral zone. The downtrend line is limiting the growth of quotes.

The recent upside move was rejected by the 50-period SMA on the 4-hour chart. However, the volume is still supportive of the upside. But this is still a big question of whether the price will break yesterday’s highs or not. So, the path of least resistance still lies on the downside.

Thus, the EUR/USD forecast for July 9 assumes the resumption of the downward movement with the price-fixing below the level of 1.18.

Support levels:

S1 – 1.1780

S2 – 1.1719

S3 – 1.1658

Resistance levels:

R1 – 1.1841

R2 – 1.1902

R3 – 1.1963

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.