- EUR/USD has been finding its feet after falling from the highs.

- Europe’s faster economic recovery, US coronavirus cases, and uncertainty about fiscal stimulus are in play.

- Monday’s four-hour chart is showing that the currency pair exited overbought conditions.

Fresh energies in a new month? EUR/USD has been trading close to 1.18 – down from its two-year highs above 1.19 but on a strong-footing. After experiencing a much-needed correction, the fundamentals underpinning the world’s most popular currency pair remain firm and are pointing to the upside.

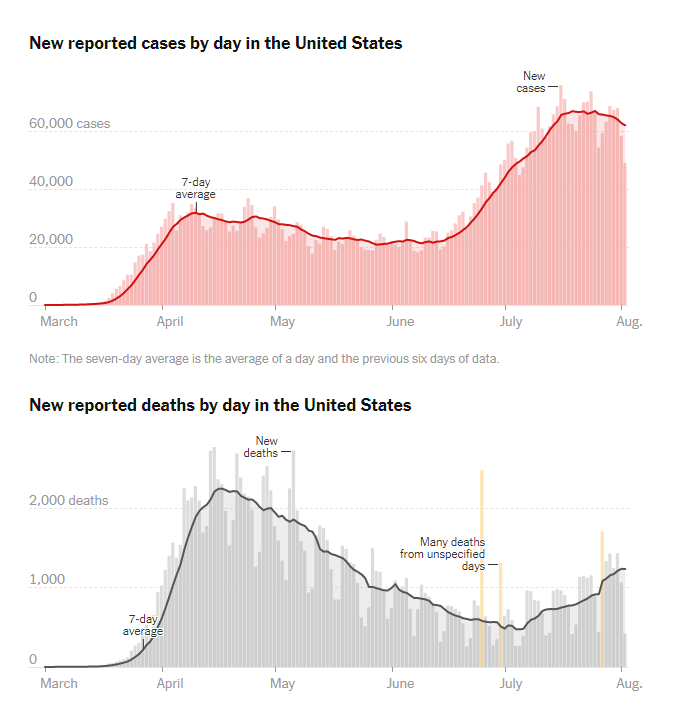

Coronavirus: While the old continent is experiencing several flareups – most notably in Spain – COVID-19 cases are under control. That cannot be said about the US, where infections top 4.6 million and deaths surpassed 155,000. The mortalities curve remains on an upward trajectory in America.

Source: New York Times

Faster recovery: The US economy squeezed by 32.9% annualized in the second quarter – or 9.5% quarterly – worse than the eurozone’s -12.1% fall. Nevertheless, strict lockdowns not only kept the disease depressed but also impact economic sentiment.

That will come to a test with Purchasing Managers’ Indexes for July. Markit’s PMIs are mostly final ones, leaving investors’ focus on the US ISM Manufacturing PMI. Expectations remain cautiously optimistic as the industrial sector is less sensitive to the virus than the services one. The forward-looking index and its employment component serve as a hint toward Friday’s all-important Non-Farm Payrolls.

See US Manufacturing PMI July Preview: Confirmation of decline?

America’s emergence from the disease also heavily depends on government support. The $600/week top-up of federal unemployment claims has played a part in keeping consumption upbeat. That support and several other special programs have lapsed at the end of July and lawmakers have failed to reach an agreement on new support.

Republicans and Democrats have scheduled further negotiations on Monday. While markets expect an imminent accord – as both parties would want to burnish their images ahead of the elections – every day that passes causes economic pain to millions that are unemployed.

Sino-American tensions remain elevated, this time around TikTok – the short-video social media network that is gaining traction in the US – and may expose Americans’ personal data to Chinese authorities. President Donald Trump wants to follow other nations and ban the application – and potentially other ones. However, Microsoft could but TikTok and provide a solution.

The world’s largest economies also clashed around Huawei, Hong Kong, and human rights in Xinjiang. Friction had previously triggered safe-haven flows supporting the dollar, but it is now weighing on the greenback.

Overall, there are more reasons to favor the euro over the dollar.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart has fallen well below 70 – exiting overbought conditions and allowing for more gains. EUR/USD continues trading above the 50, 100, and 200 Simple Moving Averages and momentum remains positive.

Immediate resistance is at 1.1780, a temporary high in late July. It is followed by 1.1805, which played a similar role. The 1.1850 peak dates to 1.1850 and the last line to watch are 1.1909 – the fresh high.

Support is at 1.1740, the daily low. It is followed by 1.17 which provided support last week. Further down, 1.1625 and 1.1540 are eyed.

More Where next for the dollar, stocks and the US economy after downbeat data and the Fed