- EUR/USD has been retreating from the highs as investors become worried about several developments.

- The European Central Bank’s decision and US retail sales are set to rock the currency pair.

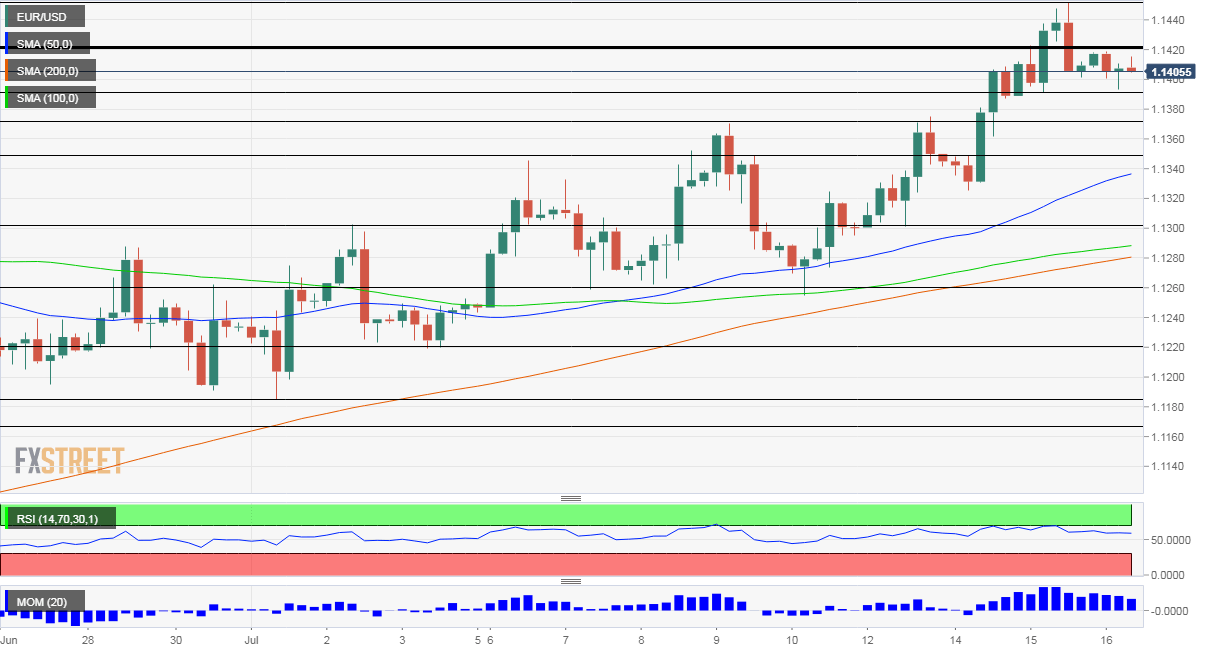

- Thursday’s four-hour chart is showing that bulls are in control.

When a currency pair holds up amid gloomy news – it is showing its strength and suggests further rallies are in store. Markets seem “hungover” focusing on good news and rallying, and now seem to begin seeing the glass half empty.

EUR/USD hit 1.1452 – the highest since March – before retreating. Nevertheless, it maintains most of its strength in what seems like a necessary and minimal downside correction before the next move up.

What is weighing on markets

Chinese data: The world’s second-largest economy bounced back from its first-quarter contraction and grew by 3.2% yearly in the second one. However, investors focused on the disappointing drop in June’s retail sales, showing that the Chinese consumer is still wary of the virus.

Sino-American relations: While President Donald Trump would not like to rock the boat ahead of the elections, reports suggesting an entry ban for all 90 million members of China’s Communist Party rattled markets. Both countries are at odds over Hong Kong, Huawei, and coronavirus.

Twitter hack: The accounts of Joe Biden, Kanye West, Barrack Obama, Bill Gates, Jeff Bezos, and others were hacked, prompting a downfall in Twitter’s shares and also of other tech firms, adding to the downbeat mood.

Vaccine reaction: Perhaps the best reflection of investors’ change of heart was seen in the response to the report that Oxford University and AstraZeneca advanced in developing a COVID-19 vaccine. The collective shrugging off by markets to the reports of “double protection” contested the cheers Moderna’s efforts received earlier in the week.

ECB, US retail sales in focus

The European Central Bank is set to stand pat in its July meeting after announcing a top-up of €600 billion to its bond-buying scheme in June. The main lending rate is forecast to remain unchanged at 0% and the deposit rate at -0.50%.

The ECB will likely take stock of the state of the economy following the coronavirus blow and the recovery. Christine Lagarde, President of the European Central Bank, will likely urge governments to act – ahead of a leaders’ summit that begins on Friday.

Negotiations between southern countries that support the recovery program and the “Frugal Four” – a group of rich countries led by the Netherlands – has been intensifying. The disputed part of the plan is the idea to provide mutually funded grants worth €500 billion to struggling countries.

See ECB Preview: EUR/USD depends on Lagarde’s fearless nudging of the Frugal Four

Lagarde begins speaking at 12:30 GMT, just as the US releases its all-important retail sales report for June. Last month began with reopening momentum before consumers began fearing the climb in COVID-19 cases and as states imposed new restrictions. Economists still expect an increase in consumption.

Weekly jobless claims are projected to continue showing a gradual recovery in the labor market, but recent figures have been mixed and the increase in infections may have hurt employment. If retail sales meet expectations, surprises in initial and continuing claims may steal the show.

See US Retail Sales Preview: Last V-shaped recovery hopes? Three reasons for upbeat figures

Later on, US coronavirus statistics will likely move markets. California, Texas, and other states have reported record numbers of cases and the death rate is also on the rise.

Overall, EUR/USD is showing resilience in face of the worsening mood – at least for now – yet risks remain prevalent.

EUR/USD Technical Analysis

Euro/dollar is trading above the 50, 100 and 200 Simple Moving Averages on the four-hour chart and momentum remains to the upside. The Relative Strength Index is below 70, thus being outside overbought conditions and allowing for further gains.

Bulls are firmly in control.

Resistance awaits at 1.1425, June’s peak, which remains relevant. It is followed by 1.1452, the fresh high. The next level to watch is 1.1495, March’s high.

Support is at 1.1390, which is the daily low, followed by 1.1375, a temporary peak on the way up. The next levels to watch are 1.1350 and 1.13.

More What to watch out for and why the dollar is king in the US coronavirus comeback