- EUR/USD picks up extra pace and approaches 1.1800.

- German IFO Business Climate surprised to the upside.

- US PCE, Personal Income/Spending, U-Mich Index next on tap.

The single currency regains the smile and lifts EUR/USD to the 1.1790 region at the end of the week.

EUR/USD bounces off 1.1760

EUR/USD so far halts three consecutive daily pullbacks, including new 2021 lows in the 1.1760 (Thursday), and manages to advance to the vicinity of the 1.1800 zone on Friday.

The likeliness of another wave of the coronavirus pandemic, further lockdown restrictions and the poor pace of the vaccination campaign in Europe all collaborate in the selling pressure around the shared currency and the deterioration of the sentiment surrounding the pair for the time being.

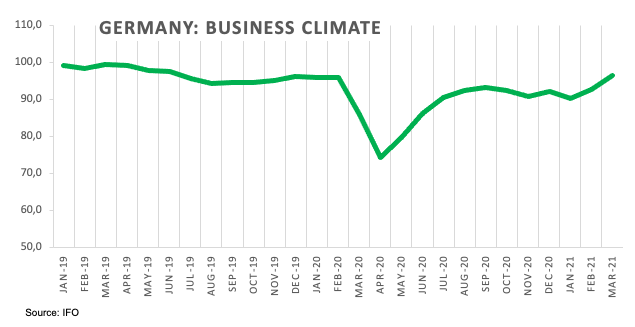

In the docket, the German Business Climate gauged by the IFO survey improved further to 96.6 in March. These results add to the auspicious data releases in the region published earlier in the week, although without any positive impact on the euro. On the IFO release, an official noted that the German economy is seen contracting 0.7% during the January-March period.

Data wise across the pond, PCE figures will take centre stage seconded by Trade Balance results, Personal Income/Spending and the final measure of the Consumer Sentiment for the month of March.

What to look for around EUR

EUR/USD remains under heavy pressure and breaks below the 1.1800 neighbourhood to record new yearly lows, always amidst increasing upside pressure around the dollar. In fact, the persistent solid performance of the greenback has been undermining the constructive view in the pair in the past weeks, as market participants continue to adjust to higher US yields, the outperformance of the US economy (vs. its G10 peers) and the deterioration of the morale in Euroland. However, the steady hand from the ECB (despite some verbal concerns) in combination with the expected rebound of the economic activity in the region in the post-pandemic stage is likely to prevent a much deeper pullback in the pair.

Key events in the euro area this week: European Council meeting (Thursday and Friday).

Eminent issues on the back boiler: Potential ECB action to curb rising European yields. EUR appreciation could trigger ECB verbal intervention, especially amidst the future context of subdued inflation. Probable political effervescence around the EU Recovery Fund.

EUR/USD levels to watch

At the moment, the index is gaining 0.20% at 1.1787 and a breakout of 1.1989 (weekly high Mar.11) would target 1.2000 (psychological level) en route to 1.2031 (50-say SMA). On the flip side, immediate contention emerges at 1.1761 (2021 low Mar.25) seconded by 1.1745 (low Nov.23 2020) and finally 1.1602 (monthly low Nov.4).