- EUR/USD regains the 1.1900 mark amidst dollar losses.

- Lower yields force the greenback to recede some ground.

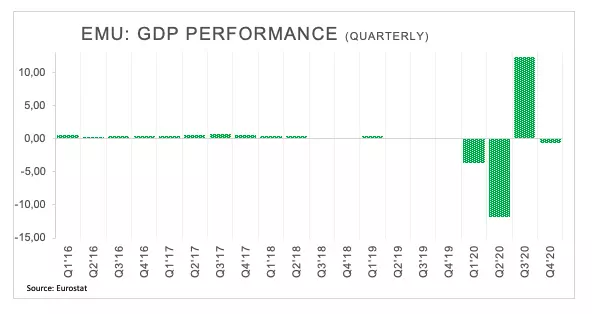

- EMU’s flash Q4 GDP contracted 0.7% QoQ, 4.9% YoY.

The single currency regains the smile and lifts EUR/USD back to the area beyond 1.1900 yardstick on turnaround Tuesday.

EUR/USD up on offered dollar

EUR/USD reverses four consecutive daily pullbacks and manage to reclaim the positive territory as well as the 1.1900 hurdle against the backdrop of renewed selling pressure in the greenback.

In fact, the dollar sees its upside momentum somewhat mitigated after hitting new YTD highs in the 92.50 area when tracked by the US Dollar Index (DXY) earlier on turnaround Tuesday, all in response to a corrective downside in US yields.

In the broader scenario, the vaccine rollout and its impact on growth prospects in the global economy continues to drive investors’ sentiment albeit relegated to a secondary role by the performance of the bonds market.

In the euro docket, advanced GDP figures showed the economy is expected to have contracted 0.7% inter-quarter during the October-December period and 4.9% on an annualized basis. In addition, the Unemployment Change rose 0.3% QoQ in the same period.

Across the pond, the NFIB Index is due seconded by the weekly report on US crude oil supplies by the API.

What to look for around EUR

EUR/USD recorded new 2021 lows in the vicinity of 1.1830 region. The solid rebound in the greenback as of late put the previous constructive stance in the euro under heavy pressure, as market participants continue to adjust to higher US yields and the outperformance of the US economy. A move below the critical 200-day SMA (around 1.1815) should shift the pair’s outlook to bearish in the near-term. In the meantime, price action around EUR/USD is expected to exclusively gyrate around the dollar’s dynamics, developments from yields on both sides of the ocean, extra fiscal stimulus in the US and the global economic recovery.

Key events in Euroland this week: ECB interest rate decision/Press Conference/Economic Projections (Thursday) – EMU’s Industrial Production (Friday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always amidst the current (and future) context of subdued inflation. Potential political effervescence around the EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is gaining 0.45% at 1.1899 and a break above 1.1976 (50% Fibo of the November-January rally) would target 1.2030 (100-say SMA) en route to 1.2113 (monthly high Mar.3). On the other hand, the next support at 1.1812 (200-day SMA) followed by 1.1762 (78.6% Fibo of the November-January rally) and finally 1.1602 (monthly low Nov.4 2020). On the flip side,