- The upside momentum loses some grip near 1.1240.

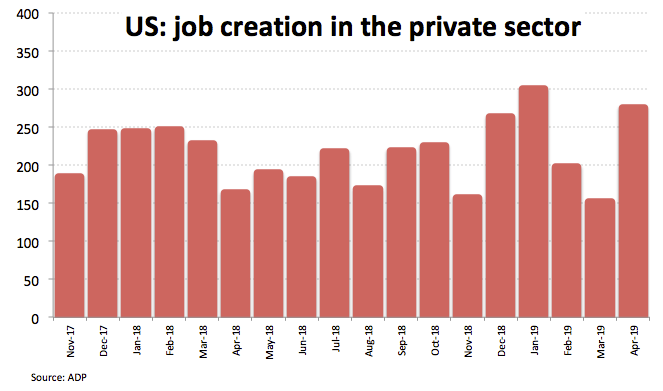

- US ADP report surprised to the upside in April.

- US ISM manufacturing, FOMC next on tap in the docket.

After clinching fresh multi-day highs near 1.1240 in early trade, EUR/USD has now met some selling pressure and retreats to the 1.1230/25 band in the wake of US ADP report.

EUR/USD upside capped near 1.1240, FOMC comes next

Spot comes under some downside and retests the 10-day SMA in the 1.1230/25 band after the US ADP report surprised markets to the upside in April. In fact, the US private sector rose by 275K during last month, beating expectations and up from March’s 151K (revised from 129K).

The better mood in the risk-associated complex continues to lend support to the European currency, which managed to already gain over a cent since last week’s yearly lows in the 1.1100 neighbourhood.

Next of significance in the NA session will be the publication of the manufacturing gauge by the ISM ahead of the FOMC event, including a press conference by Chief J.Powell. The greenback is thus expected to stay under scrutiny as market consensus appears biased towards a dovish tone with the probability of rate cuts grabbing the centre of the debate.

What to look for around EUR

Recent data in Euroland and Germany allowed market participants to believe that some healing process could be under way in the region amidst the ongoing slowdown. However, this scenario needs confirmation in the next months, while the current ‘neutral/dovish’ stance from the ECB is expected to persist for the reminder of the year and probable H1 2020. The broad-based risk-appetite trends and USD-dynamics are posed to rule the sentiment surrounding the European currency for the time being, all in combination with the onoging US-China trade dispute and potential US tariffs on EU products. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections in late May, as the populist option in the form of the far-right and the far-left movements appears to keep swelling among voting countries.

EUR/USD levels to watch

At the moment, the pair is gaining 0.11% at 1.1227 and a break above 1.1239 (high May 1) would target 1.1277 (55-day SMA) en route to 1.1323 (high Apr.17). On the other hand, immediate support emerges at 1.1109 (2019 low Apr.26) seconded by 1.0839 (monthly low May 11 2017) and finally 1.0569 (monthly low Apr.10 2017).