- EUR/USD clinched weekly highs above 1.1160.

- EMU flash CPI at 1.1% YoY in July, Q2 GDP at 1.1% YoY.

- US ADP report, Fed meeting next of relevance.

After moving beyond 1.1160 in early trade, EUR/USD has quickly given away those gains and it has now returned to the 1.1150/40 band, always within a tight range ahead of the FOMC meeting.

EUR/USD cautious ahead of Fed

Spot is now reversing the positive start of the week after meeting strong resistance in the vicinity of the 10-day SMA, currently at 1.1171.

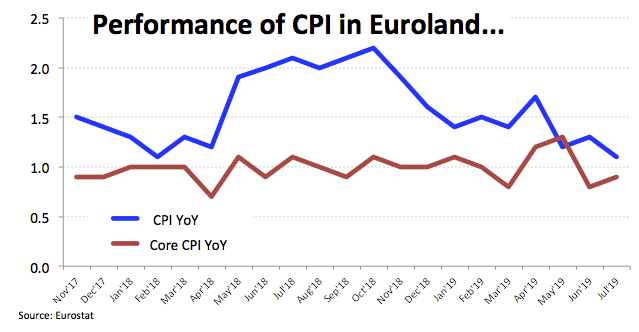

EUR saw its gains trimmed after advanced headline inflation figures in the region is seen gaining 1.1% on a year to July, while prices stripping food and energy costs are expected to gain 0.9% from a year earlier.

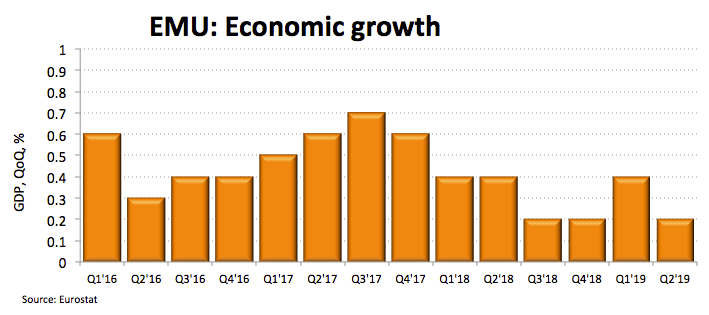

Further data in the bloc now see the economy expanding at a quarterly 0.2% during the April-June period and 1.1% on a yearly basis. The jobless rate ticked lower to 7.5% (from 7.6%).

Moving forward, the pair is seen extending the consolidative theme within the familiar range ahead of the US ADP report and the critical FOMC event later in the NA session.

What to look for around EUR

The single currency is expected to remain under scrutiny in the next weeks amidst ECB’s preparations for a fresh wave of monetary stimulus, including a potential reduction of interest rates, the re-start of the QE programme and a probable tiered deposit rate system. The ECB has already changed its forward guidance and it now expects rates to remain at ‘present or lower levels’ until at least mid-2020. The unremitting deterioration of the economic outlook in the region and the lack of traction in inflation are seen limiting any occasional bullish attempts in EUR for the time being and also give extra sustain to the dovish stance in the ECB.

EUR/USD levels to watch

At the moment, the pair is retreating 0.08% at 1.1146 and faces the next support at 1.1101 (2019 low Jul.25) seconded by 1.1021 (high May 8 2017) and finally 1.0839 (monthly low May 11 2017). On the other hand, a break above 1.1233 (55-day SMA) would target 1.1286 (high Jul.11) en route to 1.1302 (200-day SMA).