- The pair keeps the bid tone in the 1.1350/40 band.

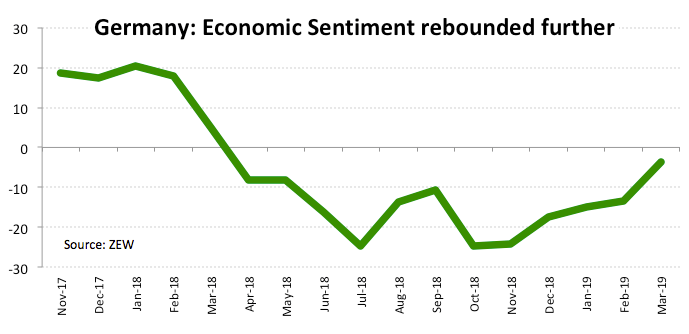

- German Economic Sentiment rebounded to -3.6.

- EMU Economic Sentiment improved to -2.5.

The upside momentum around the shared currency is now deflating despite better than expected results from the ZEW survey, taking EUR/USD to the 1.1350 region from highs near 1.1360.

EUR/USD remains bid post-data

The pair left the area of fresh 2-week highs near 1.1360 after the ZEW survey showed German Economic Sentiment extended the bounce to -3.6 for the current month and Current Conditions eased to 11.1, missing previous estimates.

In the same line, Economic Sentiment in the broader euro bloc improved to -2.5, bettering consensus. Still in Euroland, the Labor Cost Index rose at an annualized 2.30% in Q4, missing forecasts.

In the meantime, the lack of relevant catalysts leaves spot focused on the broader risk appetite trends and USD-dynamics, with no relevant news on the Brexit negotiations and the US-China trade front either.

What to look for around EUR

Market participants appear to have already adjusted to the recent and renewed dovish stance from the ECB, focusing instead on the broad risk-appetite trends as the main driver of the price action in the near term. In the longer run, the performance of the economy in the region should remain in centre stage along with prospects of re-assessment of the ECB’s monetary policy. In this regard, it is worth mentioning that investors keep pricing in the first rate hike by the central bank at some point in H2 2020. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is gaining 0.12% at 1.1349 facing the next hurdle at 1.1363 (55-day SMA) seconded by 1.1419 (high Feb.14) and finally 1.1482 (200-day SMA). On the other hand, a break below 1.1320 (21-day SMA) would target 1.1289 (10-day SM) en route to 1.1176 (2019 low Mar.7).