- The pair moves higher after testing the mid-1.1200s.

- Advanced German Q4 GDP came in flat, below estimates.

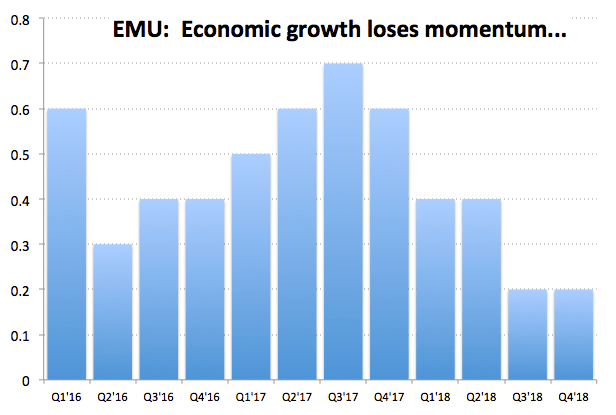

- Estimates of Q4 GDP in Euroland matched consensus at 0.2% QoQ.

Quite volatile start of the second half of the week for EUR/USD, which is now resuming the upside after bottoming out in the mid-1.1200s earlier in the session, or fresh 2019 lows.

EUR/USD bid on data, looks to USD

Spot is now retesting the upper end of the daily range after the second revision of Q4 GDP in the euro area showed the economy is expected to have expanded 0.2% inter-quarter and 1.2% on a yearly basis, both prints matching estimates.

Additional preliminary data showed the Employment Change in the bloc is seen expanding 0.3% QoQ in the October-December period and 1.2% YoY. Earlier, Germany has averted entering into technical recession in H2 2018, as Q4 GDP is expected to come in flat.

In the meantime, the shared currency is expected to remain under pressure amidst the generalized bid tone surrounding the greenback and uncertainty over the US-China trade negotiations and Brexit.

What to look for around EUR

EUR has come under strong selling pressure in past sessions against the backdrop of rising concerns over the slowdown in the region and speculations that the ECB could refrain from acting on rates this year and extend further, instead, the current ‘pause-mode’. Additionally, political concerns remain well and sound in Euroland as we get closer to the EU parliamentary elections: snap elections in Spain, the still unresolved issue of the ‘yellow vests’ in France and the omnipresent effervescence in the Italian political scenario seem to be preparing the scenario for an increasing presence of populism in the Old Continent.

EUR/USD levels to watch

At the moment, the pair is gaining 0.08% at 1.1269 facing the next hurdle at 1.1345 (10-day SMA) seconded by 1.1356 (23.6% Fibo of the September-November drop) and then 1.1385 (55-day SMA). On the other hand, a break below 1.1248 (2019 low Feb.14) would target 1.1215 (2018 low Nov.12) en route to 1.1118 (monthly low Jun.20 2017).