- EUR/USD has “sold the fact” on the impressive EU deal news.

- Rises in Italian bonds, advances toward coronavirus vaccines, and ECB support open the door to gains.

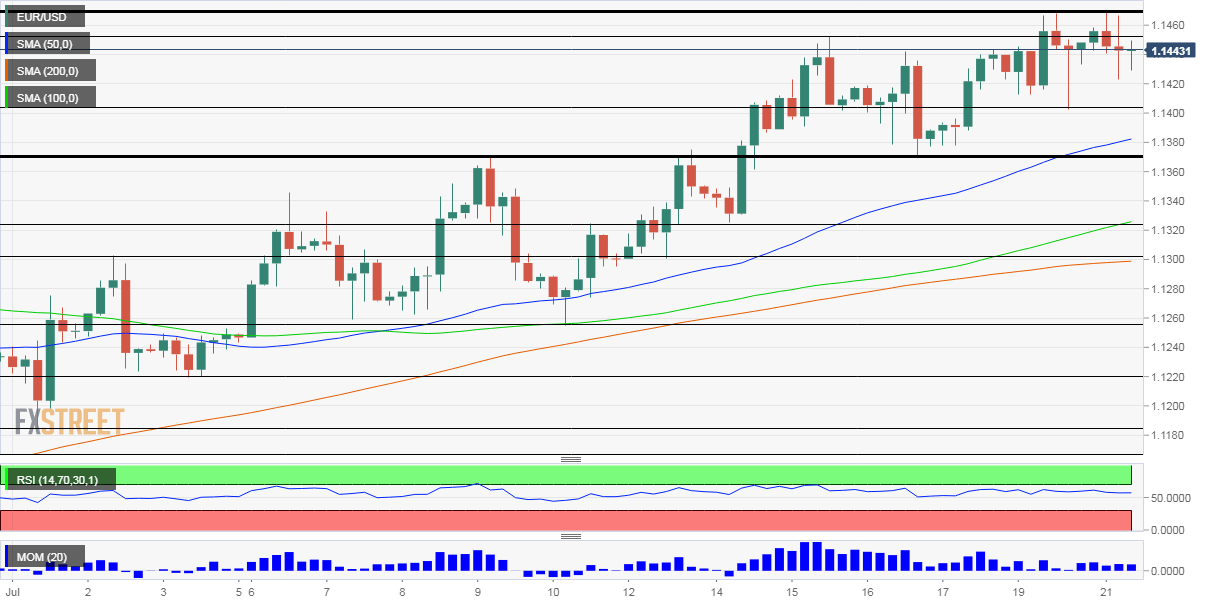

- Tuesday’s four-hour chart is painting a favorable picture for bulls.

Profit-taking – what every forex trader does after a successful trade, is what is happening to EUR/USD after the recent rally. While the world’s most popular currency pair is suffering from a “buy the rumor, sell the fact” response to the EU accord,

Italian bonds are rallying, showing enthusiasm. Spreads between the hardest-hit country’s ten-year bond yields and benchmark German ones have squeezed toward 150 basis points. The euro may play catch up as new bullish positions come into play.

What is in the EU accord? It is a pact wroth €750 billion, including landmark €390 billion in funds raised by the European Commission – Eurobonds in all but name. Mark Rutte, Prime Minister of the Netherlands, led a group dubbed the “Frugal Four” to reducing the total amount of awards from €500 billion to €390 billion, yet a compromise was always on the cards.

More importantly, the taboo on sharing the burden is broken, potentially strengthening the union and providing confidence to private investors. Also, leaders approved the seven-year EU budget ahead of schedule – an achievement that minimizes the exhausting five-day effort.

See EU Deal Analysis: EUR/USD buy opportunity? Why the move is historic and should keep the euro bid

EUR/USD has reasons to rise from the American side of the equation as well. The safe-haven dollar is on the back foot amid a lengthening list of reports about progress in developing a coronavirus vaccine and a curse.

These include efforts from the University of Oxford/AstraZeneca, BioNTech/Pfizer, and CanSinoBIO\s COVID-19 immunization advances, and Synairgen’s promising medication.

The drop in US coronavirus cases and deaths – probably a quirk related to the “weekend effect” is also cheering investors and weighing on the greenback. That may change when new American figures are released.

Another source of uncertainty from the US comes from the upcoming “fiscal cliff” – federal unemployment benefits expire in a few days and Congress has yet to get its act together to provide further stimulus. High-level talks are scheduled for later on Tuesday.

President Donald Trump seems to take COVID-19 more seriously, tweeting a photo of himself wearing a face mask and returning to holding press briefings on the disease. That has come in response to his unfavorable polls, which show a high correlation between the president’s scores on the virus and his support.

Overall, EUR/USD has reasons to rise – most importantly from the successful EU Summit – but risks related to COVID-19 may limit gains.

EUR/USD Technical Analysis

Euro/dollar is capped by 1.1470 – the level that has been capping it in recent days – yet this resistance may be broken. The currency pair is trading above the 50, 100, and 200 Simple Moving Averages on the four-hour chart and benefits from upside momentum. The Relative Strength Index is below 70 – outside overbought conditions.

Some resistance awaits at 1.1452, the previous July peak, ahead of 1.1470, which is not only the recent top but also the highest since March. Further above, 1.1495 and 1.1520 await EUR/USD.

Support is at 1.1405, a swing low from early in the week, followed by 1.1370, a stepping stone on the way up which also provided support on the way down. The next lines are 1.1325 and 1.13.