- Recovery in EUR/USD falters ahead of the 1.10 handle.

- EMU Sentix index disappointed in October.

- Investors remain vigilant on trade and US data.

EUR/USD keeps pushing higher on Monday and is now trading at shouting distance from the critical barrier at 1.10 the figure.

EUR/USD focused on data and trade

The pair is up for yet another session on Monday, although another test/surpass of the key barrier at the 1.10 mark still remains elusive.

In the meantime, renewed USD-selling keeps bolstering the rebound in spot from last week’s 2019 lows in the 1.0880/75 band, always amidst US recession fears and speculations of a more aggressive easing stance from the Federal Reserve (via extra – and larger? – interest rate cuts).

The up move in the pair comes despite the moderate rebound in US yields and the wider spread differential vs. yields of the German Bunds.

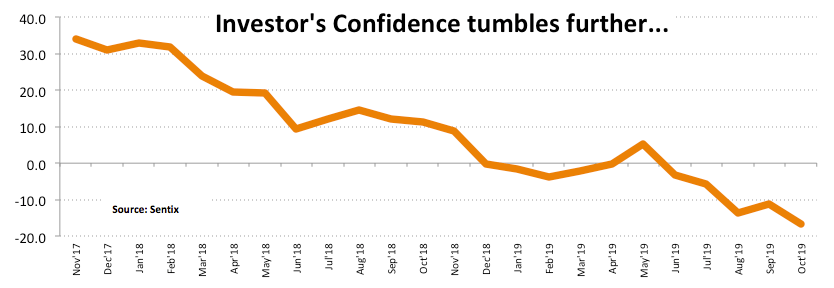

Earlier in the euro-docket, nothing to be happy about as German Factory Orders contracted more than expected during August and the Sentix index dropped to -16.8 for the current month, showing that investors’ morale remains deteriorated.

What to look for around EUR

The pair keeps the weekly recovery well and sound so far today, retaking levels close to the key 1.10 barrier on the back of increasing selling pressure hitting the Greenback. The up move in the pair, however, is seen as corrective only, as the slowdown in the region stays far from abated and carries the potential to deteriorate further, as per the latest PMIs in core Euroland and despite the lacklustre improvement in a couple of German sentiment gauges. Speaking of Germany, the likeliness that the country could slip back into recession in the third quarter just adds to the already gloomy panorama for the bloc and weighs further on the single currency. The unremitting slowdown in the region does nothing but justify the ‘looser for longer’ monetary stance by the ECB. On another front, potential US tariffs on imports of EU cars remain well on the table, while the Brexit limbo and UK politics adds to the ongoing concerns.

EUR/USD levels to watch

At the moment, the pair is advancing 0.13% at 1.0990 and faces the next resistance at 1.0998 (high Oct.7) followed by 1.1064 (55-day SMA) and finally 1.1109 (monthly high Sep.13). On the downside, a breakdown of 1.0879 (2019 low Oct.1) would target 1.0839 (monthly low May 11 2017) en route to 1.0569 (monthly low Apr.10 2017).