- EUR/USD risk reversals drop to lowest level since February 12.

- Indicates implied volatility premium for the EUR puts is on the rise.

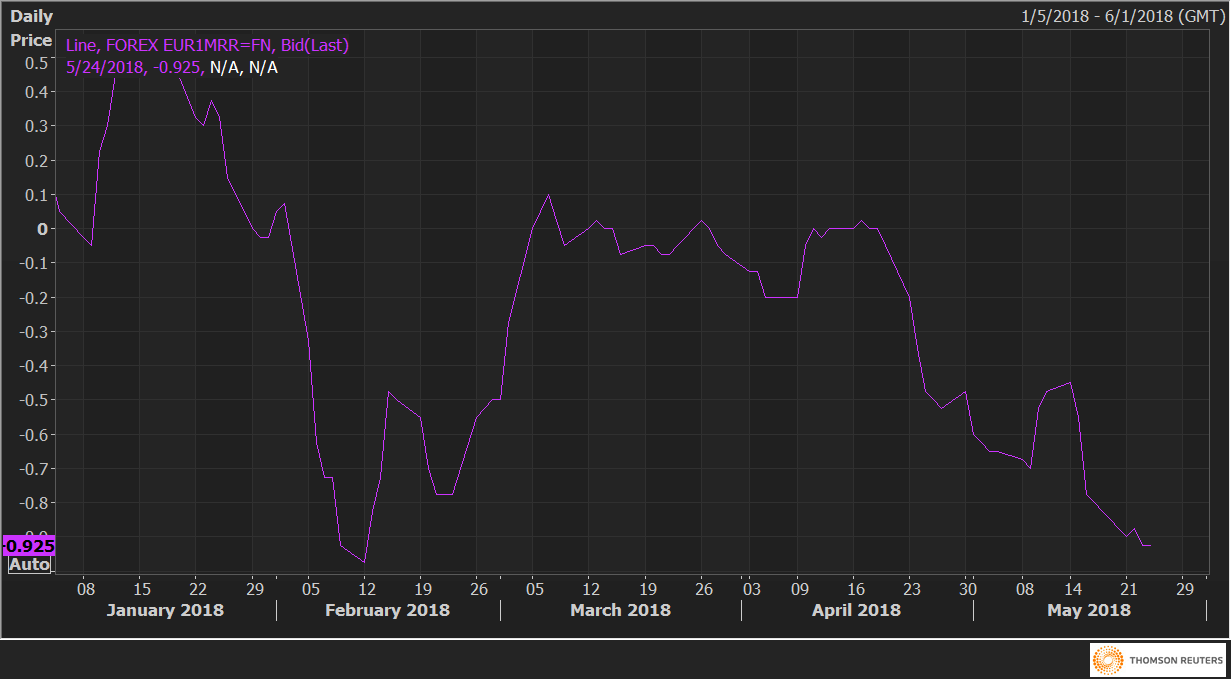

The EUR/USD one month 25 delta risk reversals (EUR1MRR) fell to -0.925 today – the lowest level since Feb. 12. The risk reversals stood at -0.45 ten days ago.

The decline from -0.45 to -0.925 represents a rise in the implied volatility premium for the EUR puts. In simple terms, it means the demand for the EUR puts (bearish bets) is on the rise.

As of writing, the EUR/USD pair is trading at 1.1710, having clocked a low of 1.1676 yesterday. The common currency is oversold for close to three-weeks, as per the 14-day relative strength index (RSI), still, corrective rallies remain elusive.

EUR1MRR