- EUR/USD adds to Thursday’s gains and approaches 1.2200.

- German flash Manufacturing PMI came in below estimates in January.

- Preliminary PMIs, Existing Home Sales, EIA next in the US docket.

The single currency extends the bullish momentum and lifts EUR/USD to the proximity of the 1.2200 level on Friday, where it appears to have lost some upside impetus.

EUR/USD now targets 1.2200

EUR/USD records gains for the second session in a row although it has now retreated from earlier peaks near 1.2200 the figure following a lower-than-expected PMI reading in Germany.

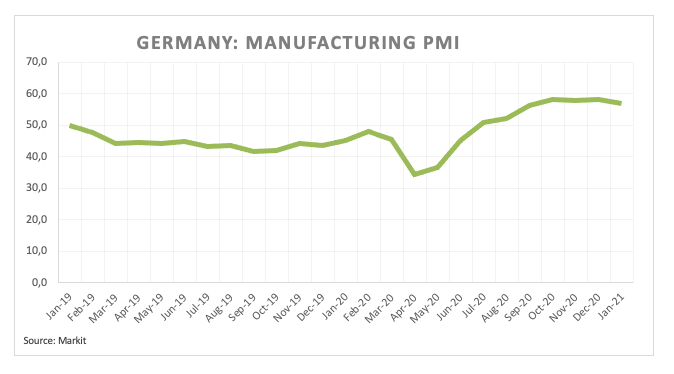

In fact, the anticipated Manufacturing PM in Germany came in a tad below consensus at 57.0 (from 58.3) for the month of January, while the same gauge surprised to the upside in France (51.5) and the broader Euroland (54.7).

The upside momentum in the pair has been sustained in past sessions by the renewed softer tone in the greenback and later by the somewhat upbeat tone from Chief Lagarde at her press conference, all following the steady stance from the ECB at its monetary policy gathering on Thursday.

Later in the US calendar, Markit will also publish its preliminary PMIs seconded by Existing Home Sales and the weekly report by the EIA.

What to look for around EUR

The recovery in EUR/USD managed to reach the area just below the 1.2200 mark on Friday. While downside pressure looks somewhat mitigated for the time being, the outlook for EUR/USD remains constructive and appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is up 0.11% at 1.2174 and a break above 1.2189 (weekly high Jan.22) would target 2349 (2021 high Jan.6) en route to 1.2413 (monthly high Apr.17 2018). On the flip side, the next support is located at 1.2071 (55-day SMA) seconded by 1.2053 (2021 low Jan.18) and finally 1.1976 (50% Fibo of the November-January rally).