- EUR/USD has been extending its losses, trading at the lowest since April 2017.

- The focus shifts to the US consumer after German data disappointed.

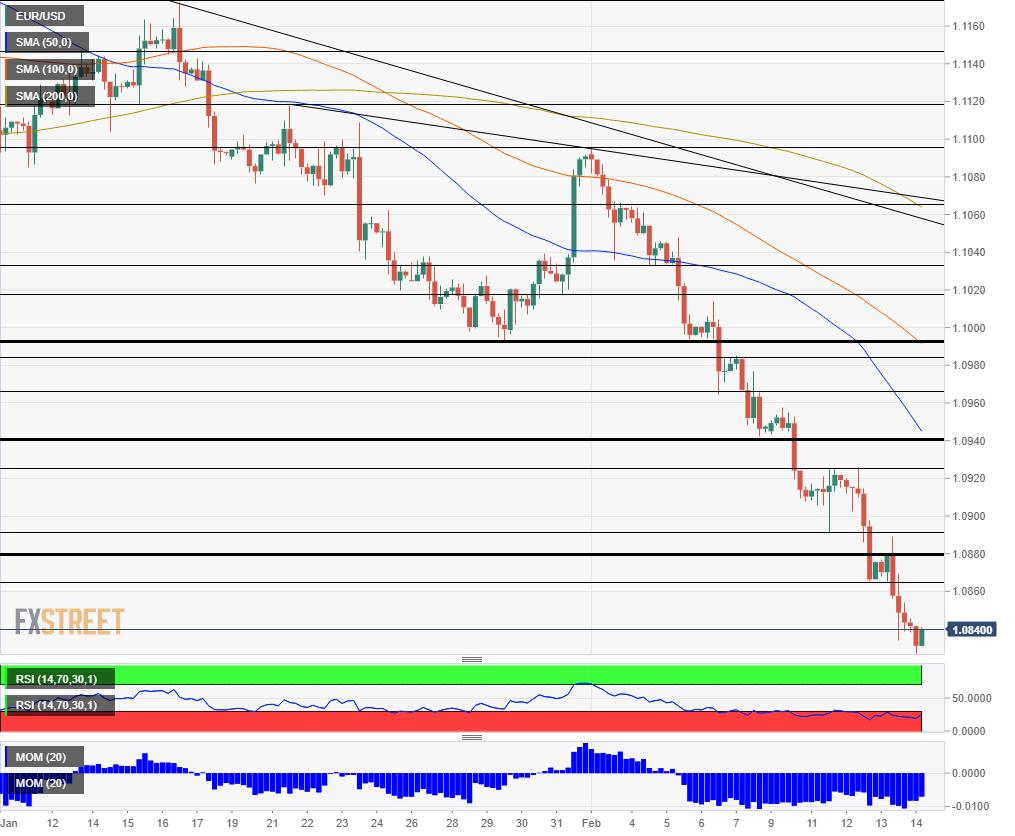

- Friday’s four-hour chart is pointing to oversold conditions ahead of the “Macron Gap.”

Is the only way down? Yet another downbeat data point has fueled EUR/USD’s slump – the German economy stagnated in the fourth quarter of 2019. Economists expected an increase of 0.1%. Yearly growth is a meager 0.4%, worse than estimates from Berlin. Revised Gross Domestic Product figures for the whole eurozone are due out and could also point to zero growth – down 0.1% initially reported.

This economic divergence between eurozone weakness and US dollar strength will be tested later in the day. Markets expect the American shopping spree to have extended into 2020. Expectations stand at an increase of 0.3% in the headline figure and also the all-important Control Group – the “core of the core.”

See Retail Sales Preview: Jobs and consumption are the core of the US economy

A more up-to-date look at the driver of the US economy is also eyed. The University of Michigan’s preliminary Consumer Sentiment Index for February is set to show a minor decline from January’s 99.8 score – but that would still reflect robust optimism.

See Consumer Sentiment Preview: Looking in the labor market mirror

Fiscal policy is one of the causes of the growth gap on both sides of the Atlantic. The US has an elevated deficit and ballooning debt, while Germany and other eurozone countries are sticking to fiscal prudence. Currency traders are cheering investment – ignoring the impact on the debt. The reshuffle in the British government opens the door to infrastructure expenditure – and the pound rallied.

Without Berlin changing its chip on investment, it is hard to see the euro area recovering.

Coronavirus (relative) calm

Coronavirus headlines remain high on traders’ agenda, but markets are mostly calm. China reported around 63,000 total cases early on Friday, a slower increase than on Thursday. While most factories in the world’s second-largest economy have returned to work, the Hubei province – the epicenter of the outbreak and home to the country’s automotive industry – remains under lockdown.

Outside of China, concerns are growing for holiday goers on the Princess Diamond, a ship stranded in Japan’s Yokohama Bay. The ramifications are spreading to Europe, where policymakers define the coronavirus as a significant risk. Barcelona is reeling from the cancelation of the World Congress – a mobile phone show that attracts 100,000 visitors every year.

While US stocks declined – partly in response to the leap in cases reported by China – panic is far from being the order of the day. Stable stocks and stable bond yields are leaving room for economic divergence and speculation of monetary policy to have their say.

However, as news related to the respiratory disease continues through the weekend, investors may prefer caution ahead of the close. That may push equities lower and cause some to seek the safety of the US dollar.

Overall, top statistics and coronavirus headlines are set to dominate trading.

EUR/USD Technical analysis

The Relative Strength Index on the four-hour chart is below 30 – implying oversold conditions and a potential bounce. However, that may be insufficient to stop euro/dollar’s fall. Also, previous recoveries have been shortlived and limited – dead-cat bounces.

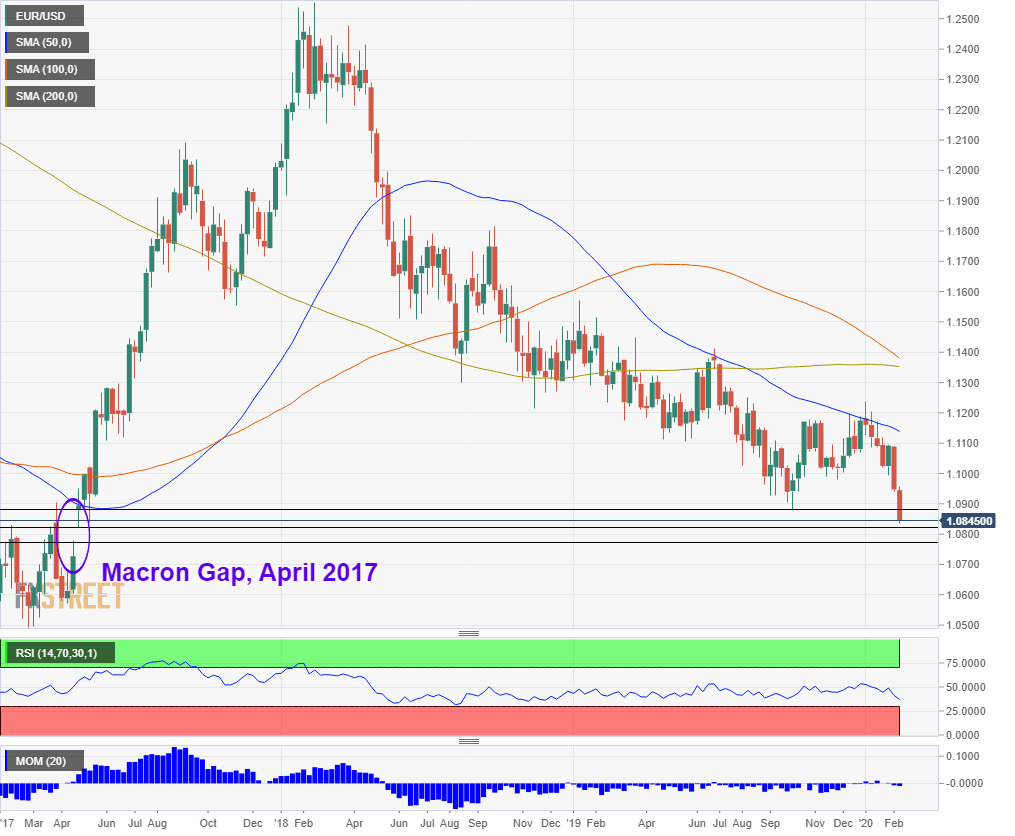

EUR/USD has hit a low of 1.0827, just above the “Macron Gap” level of 1.0820, which was seen after the now President of France, Emmanuel Macron, won the first round of the elections in April 2017.

Here is how the Macron Gap looks on the weekly chart:

On the other side of that Sunday gap from nearly three years ago, we find 1.0770 and 1.0720 as potential support lines.

Looking up, resistance is at Thursday’s temporary support line at 1.0865, followed by the 2019 trough of 1.0879. Next, 1.0905, 1.0940, and 1.0965 played a role on the way down and may also cap it on the way up.