- Monday’s inverted hammer candle indicates EUR/UD’s rally has run out of steam.

- Options market continues to add bullish bets, suggesting a continuation of the rally.

EUR/USD fell 0.18% on Monday, snapping the four-day winning streak.

Notably, the pair formed an inverted hammer on Monday, signaling the rally from Oct. 1’s low of 1.0879 has run out of steam.

Also, Monday’s candlestick pattern has made today’s close pivotal. A bearish reversal would be confirmed if the spot ends below Monday’s low of 1.1139. Meanwhile, a close above Monday’s high of 1.1179 would mean a continuation of the rally.

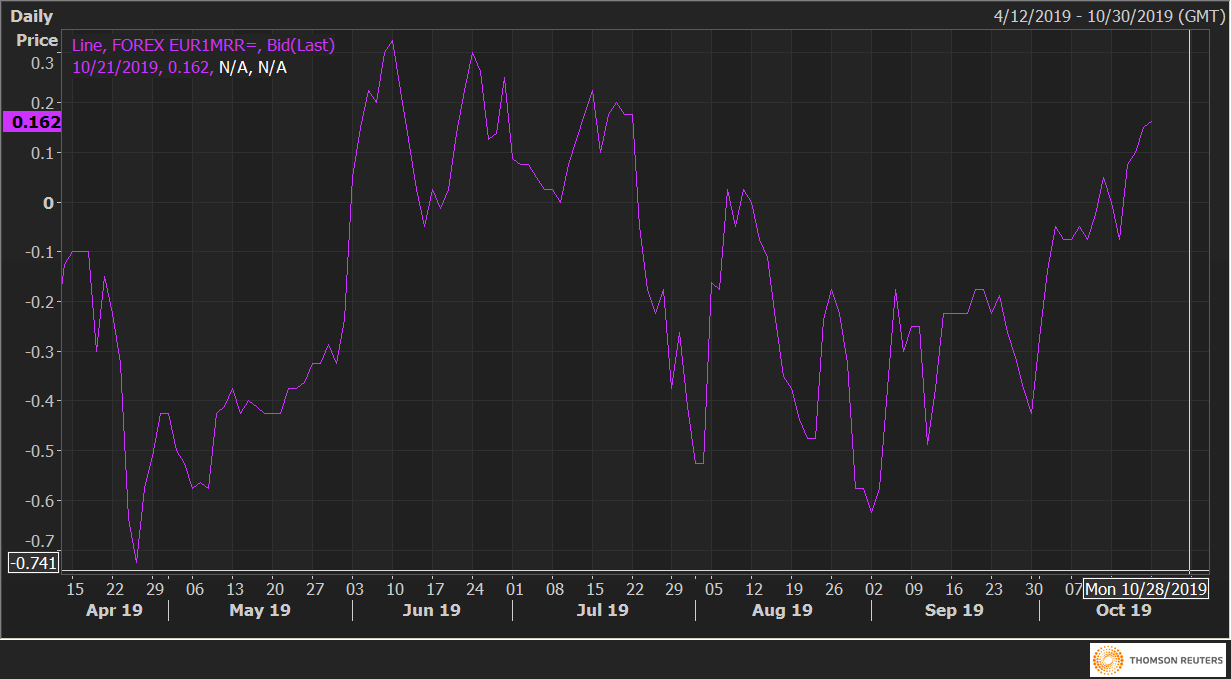

A bullish close looks likely, according to the options market. One-month risk reversals, a gauge of calls to puts on the common currency, jumped to 0.162 on Monday, the highest level since July 22. The positive number indicates the implied volatility premium for calls (bullish bets) is higher than that for puts (bearish bets).

Put simply, investors added a premium for calls (added bullish bets) despite the pullback in the spot.

Further, the risk revival seen in the stock markets, possibly due to the easing of US-China trade tensions could bode well for the

common currency.

As of writing, EUR/USD is trading largely unchanged on the day at 1.1150.

The pair may suffer a bearish close if the UK’s parliament does not agree to the Brexit timetable, possibly leading to a drop in GBP/USD. The 115-page Brexit bill published by the UK government on Monday will get its second reading in the House of Commons on Tuesday.

EUR1MRR

Technical levels