- The pair navigates within a tight range around 1.1200.

- The greenback looks for direction near 97.40, 3-week highs.

- Focus has now shifted to 2019 lows around 1.1180.

The sentiment surrounding the European currency remains depressed in the first half of the week and has now forced EUR/USD to return to the 1.1200 neighbourhood.

EUR/USD now looks to YTD lows

Spot is down for yet another session, extending the bearish move to the 1.1200 handle and a tad below on Tuesday, opening at the same time the door for a potential new visit to yearly lows in the 1.1180/75 band.

The recent optimism around the riskier assets on the back of positive Chinese data appears to have been losing traction during past hours, motivating the pair to fade yesterday’s uptick to daily tops in the mid-1.1200s.

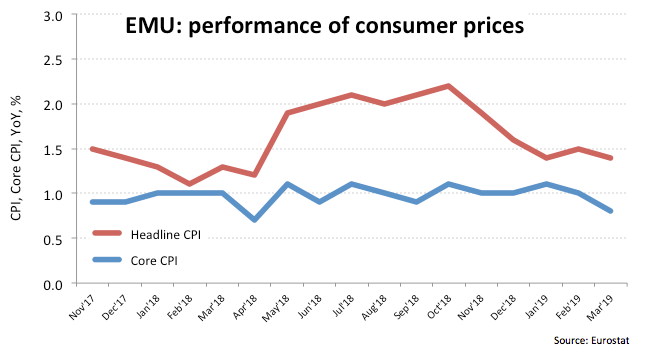

EUR has also shed some ground in response to poor advanced inflation figures in Euroland for the month of March (published on Monday), which fell in line with German data seen at the end of last week.

In the data space, Producer Prices in the region are only due along with a speech by ECB’s P.Praet. Across the ocean, February’s Durable Goods Orders and the API report on US crude oil supplies are expected later in the NA session.

What to look for around EUR

EUR remains under heavy pressure following poor results in Euroland, somehow confirming that the slowdown in the region could stay for longer as well as the patient stance from the ECB. Against the backdrop of souring risk-appetite trend, the greenback should emerge stronger and is expected to keep weighing on spot for the time being. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is retreating 0.10% at 1.1201 and faces the next support at 1.1195 (low Apr.2) followed by 1.1176 (low Mar.7) and finally 1.1118 (monthly low Jun.20 2017). On the other hand, a break above 1.1250 (high Apr.1) would target 1.1284 (21-day SMA) en route to 1.1337 (200-week SMA).