- EUR/USD bottomed out in the 1.2030/25 band on Tuesday.

- The dollar remains firm and clinches new yearly highs.

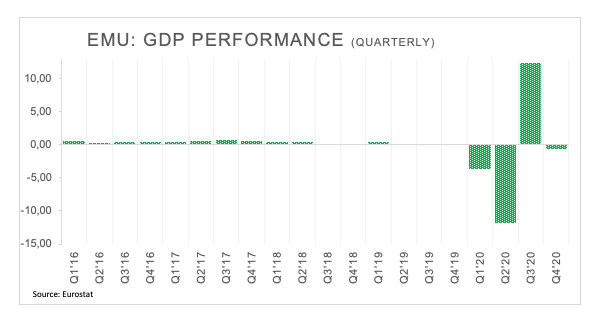

- EMU’s flash GDP came in above expectations in Q4.

The selling note remains well and sound around the European currency, although EUR/USD manages to leave behind the area of recent YTD lows near 1.2020.

EUR/USD exposes a move to 1.2000

EUR/USD extends the sour mood into Tuesday’s session and tumbled to new 2021 lows near 1.2020, opening the door to a potential re-visit to the psychological mark at 1.20 the figure in case the selling impetus picks up extra pace.

In the meantime, higher US yields and a context favourable to the risk aversion continue to lend support to the buck, which trades in the area of yearly tops near 90.20 when tracked by the US Dollar Index (DXY).

Collaborating with the move up in the dollar, Dallas Fed R.Kaplan suggested that the rise in yields is a good sign and he expects higher yields as the economy keeps growing. He also said that any debate on policy normalization is still premature, adding that part of the current situation in financial markets is linked to the Fed’s policy and liquidity.

In the domestic docket, advanced GDP figures in the Euroland showed the region is projected to contract 0.7% during the October-December period and 5.1% on an annualized basis, both prints coming in a tad above estimates.

In the NA session, the IBD/TIPP Index is next on tap followed by the API’s weekly report and speeches by FOMC’s L.Mester (Cleveland) and J.Williams (New York).

What to look for around EUR

Occasional legs lower in EUR/USD remain contained in the 1.2050 band so far. The near-term outlook for the pair looks tilted towards some consolidation, although it appears constructive in the longer run and always supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is down 0.16% at 1.2040 and faces immediate contention at 1.2026 (2021 low Feb.2) seconded by 1.2000 (psychological mark) and finally 1.1976 (50% Fibo of the November-January rally). On the other hand, a breakout of 1.2173 (23.6% Fibo of the November-January rally) would target 1.2189 (weekly high Jan.22) en route to 1.2349 (2021 high Jan.6).