- The pair drops and rebounds from the 1.1290 zone.

- German, EMU flash PMIs expected on the weak side in March.

- EU Summit and Brexit stays in centre stage.

EUR/USD remains under pressure at the end of the week although it has now regained some shine above the 1.1300 handle.

EUR/USD supported near 1.1290

The pair shed around a cent since daily highs in the 1.1390 region to the 1.1290/85 band recorded in the wake of miserable advanced readings from German and EMU manufacturing PMIs for the current month.

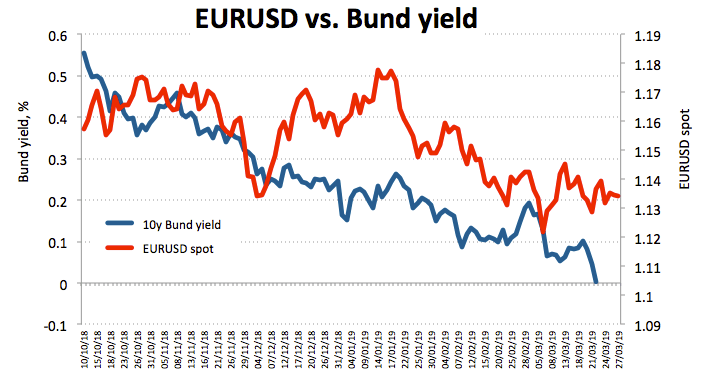

The correction lower in spot has come along a moderate drop in yields of the key 10-year German Bund below the psychological 0% milestone, widening the spread vs. its American peer.

Spot managed to grab some attention after President Trump now said that negotiations between US and China are going well, all after slipping the chance that talks could take longer than expected just a few days ago.

In addition, ECB’s Y.Mersch stressed that monetary policy should be prudent and forward-looking.

What to look for around EUR

Market participants have left behind the recent and renewed dovish stance from the ECB, focusing instead on the broad risk-appetite trends and USD-dynamics as the main drivers of the price action. Looking to the broader picture, the performance of the economy in the region should remain in centre stage along with prospects of re-assessment of the ECB’s monetary policy. In this regard, it is worth mentioning that investors keep pricing in the first rate hike by the central bank at some point in H2 2020. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is down 0.69% at 1.1294 facing the next support at 1.1234 (low Feb.15) seconded by 1.1215 (2018 low Nov.12) and finally 1.1176 (2019 low Mar.7). On the flip side, a breakout of 1.1448 (high Mar.20) would target 1.1478 (200-day SMA) en route to 1.1514 (high Jan.31).