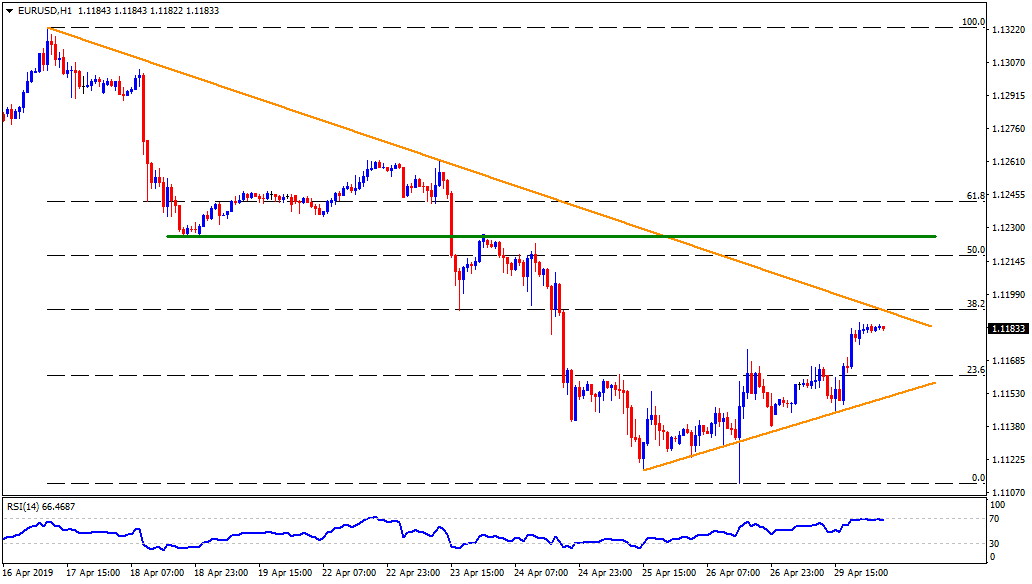

- 38.2% Fibo and a fortnight old resistance-line seem to challenge immediate upside.

- Overbought RSI levels also flash warning signals for buyers.

EUR/USD is struggling around 1.1185 during early Tuesday as overbought conditions of 14-bar relative strength index (RSI) questions the quote’s recovery from 1.1110.

Not only RSI but 38.2% Fibonacci retracement of its April 17 to 26 downturn and a fortnight-long descending trend-line could also confine pair’s near-term advances around 1.1200 mark.

In a case where prices cross 1.1200 barrier, 1.1210 and a horizontal line connecting April 18 lows to April 24 highs near 1.1230 might try to limit the upside towards 1.1260 and 1.1280.

Should sellers prefer concentrating on RSI and fail to surpass 1.1200, 1.1165 may offer immediate support ahead of highlighting upward sloping support-line near 1.1150.

If the pair slip beneath 1.1150, 1.1125 and 1.1110 can gain bears’ attention.

EUR/USD hourly chart

Trend: Pullback expected