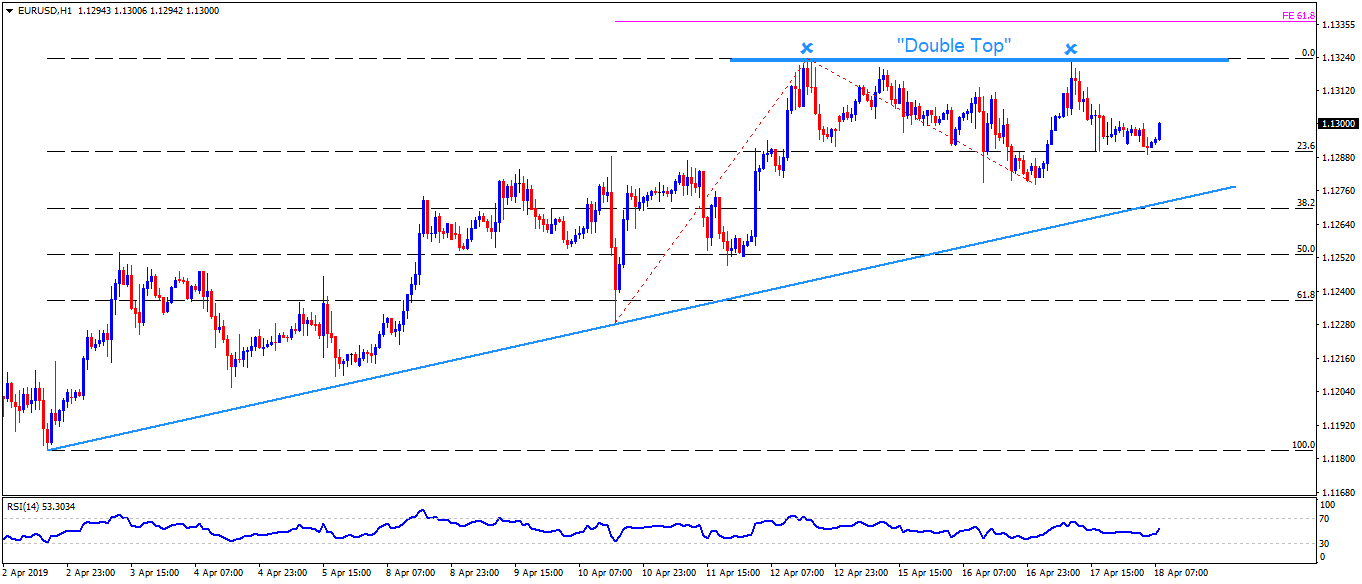

EUR/USD is taking the bids around 1.1300 ahead of the European open on Thursday. The pair highlights double tops near 1.1325 as a crucial resistance contrasts to an ascending trend-line stretched since early April.

From the current levels, 1.1310 can act as intermediate halt ahead of challenging 1.1325, a break of which can propel the quote to further up towards 61.8% Fibonacci expansion (FE) of its April 10-17 moves, at 1.1340.

It should also be noted that 100-day simple moving average (SMA) on the daily chart at 1.1350 and more than three-month-old downward sloping trend-line resistance, at 1.1390, may challenge Bulls after 1.1340.

Meanwhile, 1.1280 can offer nearby support to the pair ahead of 1.1270 level comprising aforementioned trend-line.

Given the prices drop under 1.1270, 1.1250, 1.1210 and 1.1180 might flash on Bears’ radar.

EUR/USD hourly chart

Trend: Bullish