- EUR/USD extends recovery from 61.8% Fibonacci retracement.

- Overbought RSI conditions add strength to the resistances.

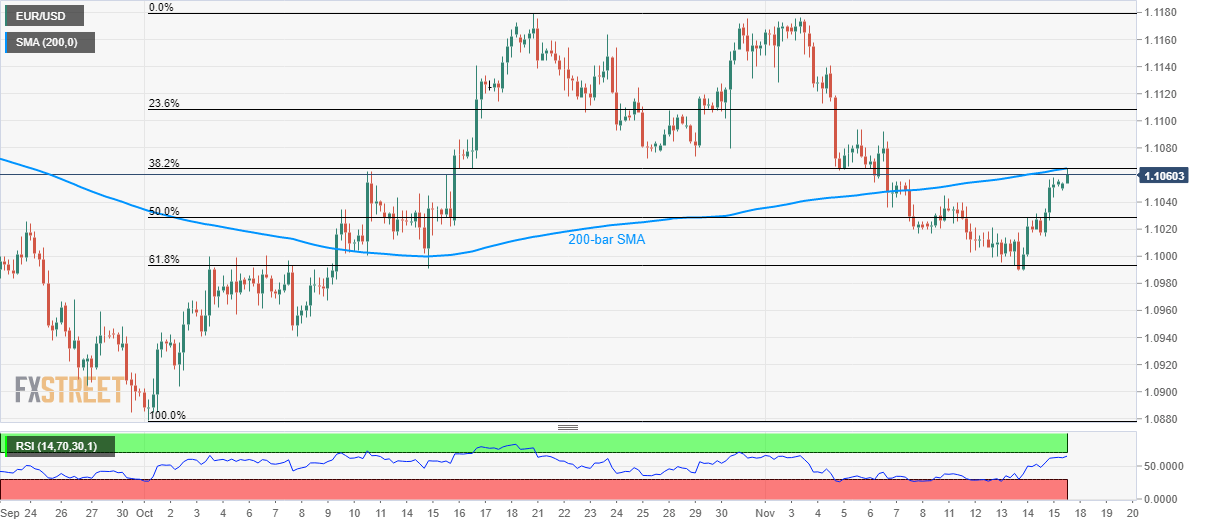

The EUR/USD pair’s successful recovery from 61.8% Fibonacci retracement flashes a seven-day high of 1.1065 by the press time of early Monday.

Even so, overbought conditions of 14-bar Relative Strength Index join 200-bar Simple Moving Average (SMA) and 38.2% Fibonacci retracement level of October month rise to question pair’s further upside.

Additionally, late-October low near 1.1070/75 and November 06 high around 1.1095 could question pair’s run-up beyond 1.1065, if not then 1.1130 and the previous month high around 1.1180 could lure buyers.

Alternatively, 50% and 61.8% Fibonacci retracement levels of 1.1030 and 1.1000 respectively could limit pair’s near-term declines ahead of October 08 and 03 lows near 1.0940.

If at all sellers refrain from respecting 1.0940, October month low surrounding 1.0880 will be the sellers’ choice.

EUR/USD 4-hour chart

Trend: Pullback expected