- The EUR/USD pair’s recent pullback stays below near-term key resistance.

- A sustained downside break could recall October month lows.

- 1.1180/75 keeps the key to the pair’s rally.

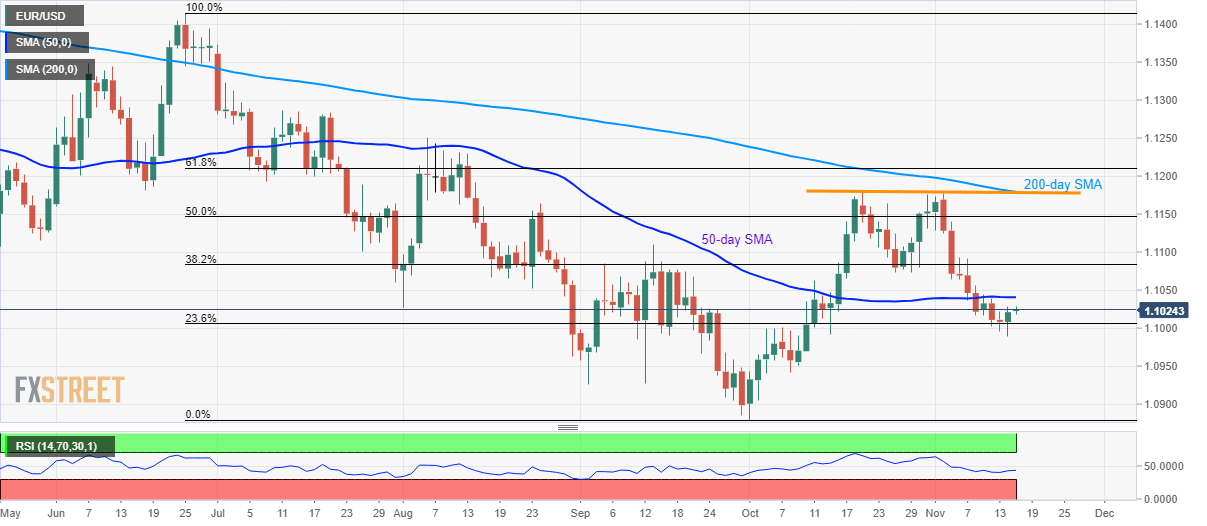

EUR/USD buyers look for confirmation, despite recent bounce, as prices still trade below the near-term key moving average, around 1.1025, during early Friday.

The 50-day Simple Moving Average (SMA) level of 1.1040 acts as immediate upside barrier to the pair holding gate for a further recovery towards late-October low surrounding 1.1075/80 and then a rise to 1.1130.

However, any further upside will have to conquer 1.1175/80 confluence including 200-day SMA and multiple tops since October 21.

Meanwhile, pair’s failure to keep the gains and a decline below the recent low of 1.0989 could recall early-October levels close to 1.0940 and 1.0880 to the chart.

EUR/USD daily chart

Trend: Bearish