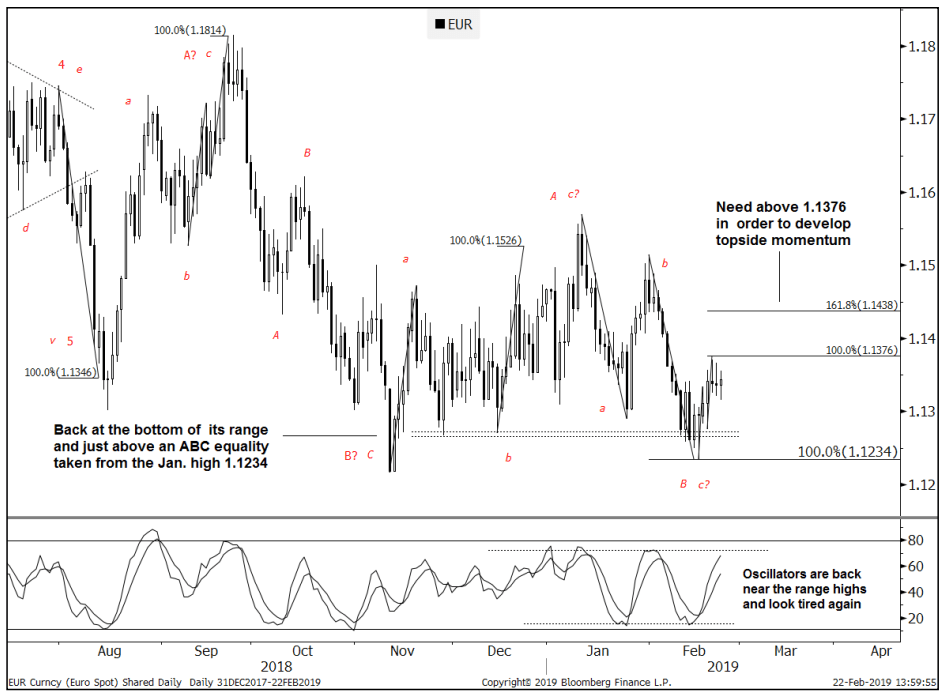

Analysts at Goldman Sachs offer an Elliot wave analysis on the EUR/USD pair, with the upside looking more promising above 1.1376 supply zone.

Key Quotes:

“EURUSD tested/held strong support at 1.1234.

The recovery since then has however been pretty poor. In the broader scheme of things, it’s right at the bottom of a range that’s held since August last year ~1.12.

Range highs are now at 1.15-1.16. It’s difficult to chase the market lower from here given that none of what has transpired since January has looked impulsive. That being said, the recent rally has been equally difficult and overlapping.

The next notable resistance is 1.1376; an ABC from the February low. Getting through there might suggest some momentum in the near-term allowing for continuation towards 1.1438 at least. Failure to break 1.1376 does however imply that the recovery is once again corrective/counter-trend.

View: Need above 1.1376 to develop momentum. Opens at least 1.1438, with scope to reach ~1.15. Longer-term bearish below 1.1234.”