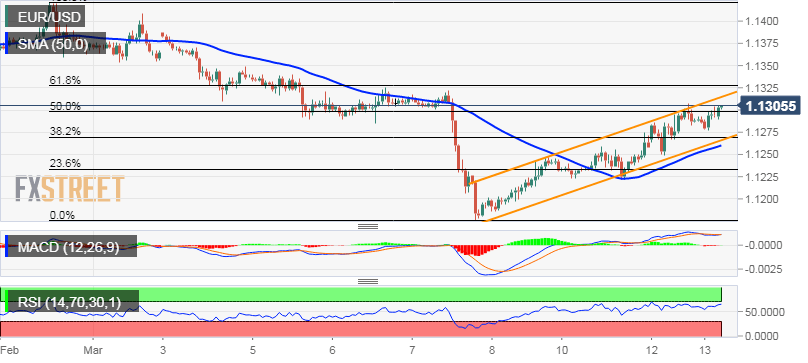

“¢ The pair maintained a mildly positive tone through the mid-European session, albeit continued with its struggle to build on the momentum further beyond the 1.1300 mark.

“¢ The mentioned handle coincides with 50% Fibonacci retracement level of the 1.1422-1.1176 recent slump and hence, should act as a key pivotal point for intraday traders.

“¢ Looking at a slightly bigger picture, the post-ECB recovery from the lowest level since June 2017 has been along an ascending trend-channel formation on the 1-hourly chart.

“¢ Given the recent decline over the past two weeks or so, the channel seemed to have constituted towards the formation of a bearish continuation flag chart pattern.

“¢ Hence, any subsequent move beyond the 1.1300 handle seems more likely to remain capped, rather meet with some fresh supply near the 1.1320 region (pre-ECB swing high).

“¢ Meanwhile, a convincing break below the 1.1270 confluence region – comprising of 38.2% Fibo. level, 50-hour SMA and the channel support, will further reinforce the bearish outlook.

EUR/USD 1-hourly chart

EUR/USD

Overview:

Today Last Price: 1.1302

Today Daily change: 15 pips

Today Daily change %: 0.13%

Today Daily Open: 1.1287

Trends:

Daily SMA20: 1.1315

Daily SMA50: 1.1369

Daily SMA100: 1.1371

Daily SMA200: 1.1494

Levels:

Previous Daily High: 1.1308

Previous Daily Low: 1.1244

Previous Weekly High: 1.1388

Previous Weekly Low: 1.1176

Previous Monthly High: 1.1489

Previous Monthly Low: 1.1234

Daily Fibonacci 38.2%: 1.1283

Daily Fibonacci 61.8%: 1.1268

Daily Pivot Point S1: 1.1252

Daily Pivot Point S2: 1.1217

Daily Pivot Point S3: 1.1189

Daily Pivot Point R1: 1.1315

Daily Pivot Point R2: 1.1343

Daily Pivot Point R3: 1.1378