- EUR/USD recovers from near-term key support lines.

- 100-day SMA, the three-week-old rising trend line will challenge buyers.

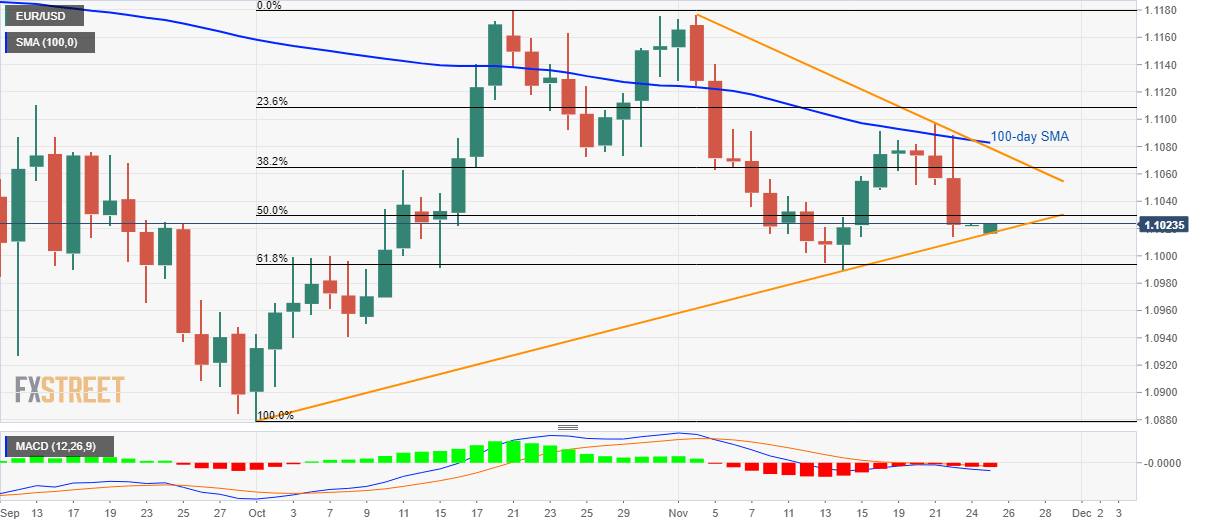

EUR/USD takes the bids to 1.1025 during the Asian session on Monday. The pair recently recovered from an upward sloping trend line since October 01.

As a result, buyers will target 50% Fibonacci retracement of the previous month upside, at 1.1030, as immediate resistance ahead of confronting 38.2% Fibonacci retracement level near 1.1065.

Though, 1.1080/85 area including 100-day Simple Moving Average (SMA) and a falling trend line since November 04 could keep pair’s further upside in check.

Alternatively, pair’s declines below 1.1015 support line will shift the market’s focus to 61.8% Fibonacci retracement level of 1.0994 and October 08 low near 1.0940.

If bears dominate past-1.0940, the October month’s bottom close to 1.0880 will become their favorite.

Traders should observe that the 12-bar Moving Average Convergence and Divergence (MACD) indicator keeps flashing bearish signals and raise doubts on any recovery.

EUR/USD daily chart

Trend: Pullback expected