“¢ The shared currency continues to benefit from an overnight report that some ECB members see end-2019 rate hike as too late.

“¢ The prevalent USD selling bias provides an additional boost and lifts the pair to over one-week high, just above the 1.1700 handle.

“¢ Short-term technical indicators hold in neutral territory and are still far from supporting an extension of the ongoing positive momentum.

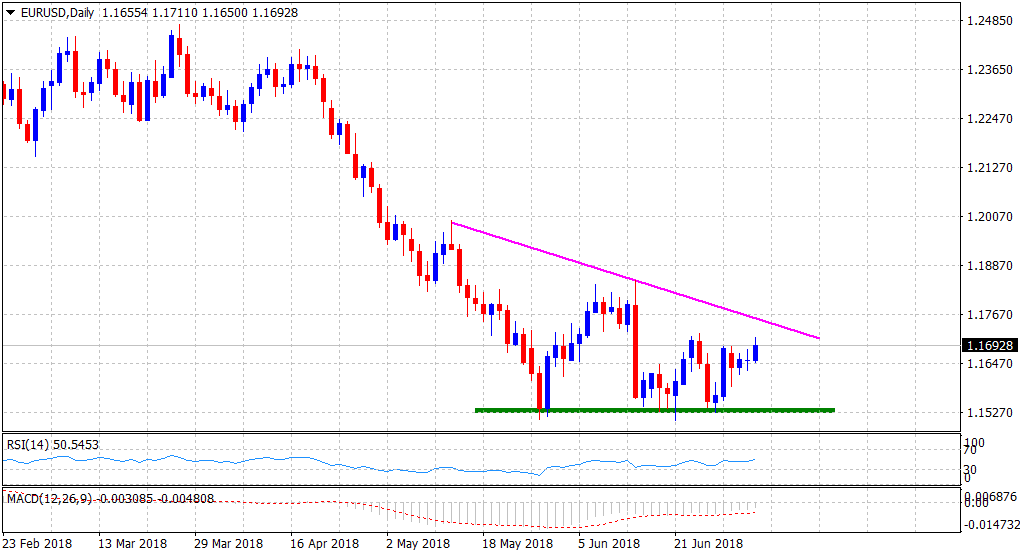

“¢ Meanwhile, the formation of a descending triangle points to a bearish set-up on the daily chart and should keep a lid on any subsequent up-move in the near-term.

EUR/USD daily chart

Spot Rate: 1.1693

Daily Low: 1.1650

Daily High: 1.1711

Trend: Bearish

Resistance

R1: 1.1720 (June 26 swing high)

R2: 1.1754 (triangle hurdle)

R3: 1.1792 (pre-ECB daily closing)

Support

S1: 1.1631 (overnight closing level)

S2: 1.1604 (S2 daily pivot-point)

S3: 1.1591 (weekly swing low set on Monday)