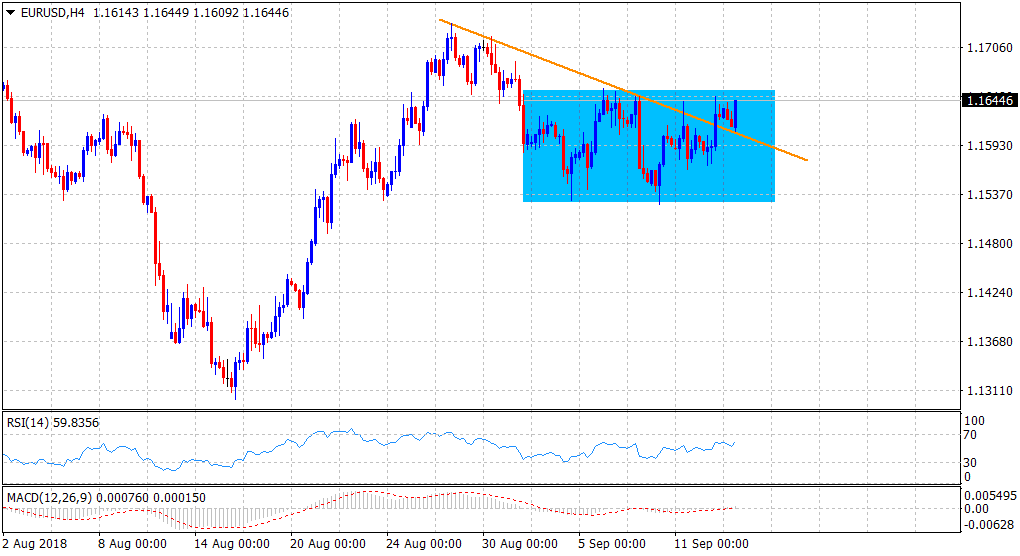

“¢ The pair built on overnight bullish move beyond a short-term descending trend-line hurdle but remained within a broader trading range held over the past two weeks.

“¢ Unimpressive ECB monetary policy statement did little to provide any impetus, though the up-move was supported by softer US CPI figures for the month of August.

“¢ Neutral Technical indicators on the 4-hourly chart have failed to support any firm directional bias, suggesting an extension of the range-bound trading action.

“¢ Hence, it would be prudent to wait for a decisive break through the broader trading range before investors start positioning for the pair’s next leg of directional move.

Spot Rate: 1.1645

Daily Low: 1.1609

Trend: Range-bound

Resistance

R1: 1.1660 (top end of the trading range)

R2: 1.1700 (round figure mark)

R3: 1.1741 (R3 daily pivot-point)

Support

S1: 1.1580 (S1 daily pivot-point)

S2: 1.1550 (horizontal zone)

S3: 1.1526 (Sept. 10 swing low)