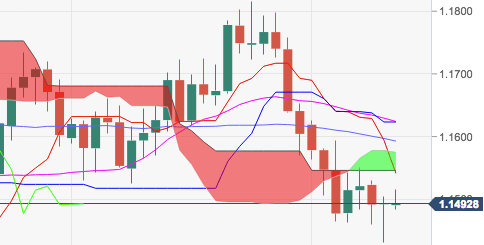

- EUR/USD managed to revert yesterday’s drop to the 1.1430 region and it has so far regained the 1.1500 neighbourhood.

- This is a key area and the pair could likely attempt some consolidation ahead of the next move, which could be in any direction.

- Interim hurdle lines up at the 10-day SMA at 1.1538 ahead of the 21-day SMA at 1.1626.

- On the other hand, a break below of yesterday’s low in the 1.1435/30 band should allow a test of the critical 200-week SMA in the 1.1330 zone.

EUR/USD

Overview:

Last Price: 1.1494

Daily change: 2.0 pips

Daily change: 0.0174%

Daily Open: 1.1492

Trends:

Daily SMA20: 1.1631

Daily SMA50: 1.1588

Daily SMA100: 1.1632

Daily SMA200: 1.1928

Levels:

Daily High: 1.1504

Daily Low: 1.143

Weekly High: 1.1625

Weekly Low: 1.1464

Monthly High: 1.1816

Monthly Low: 1.1464

Daily Fibonacci 38.2%: 1.1476

Daily Fibonacci 61.8%: 1.1459

Daily Pivot Point S1: 1.1447

Daily Pivot Point S2: 1.1402

Daily Pivot Point S3: 1.1373

Daily Pivot Point R1: 1.1521

Daily Pivot Point R2: 1.1549

Daily Pivot Point R3: 1.1594