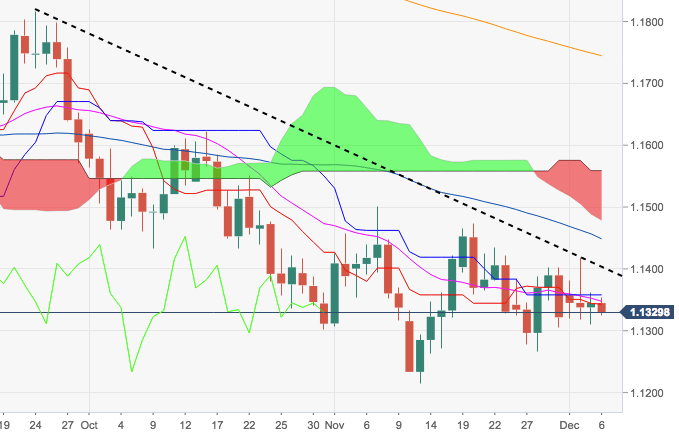

- EUR/USD is prolonging the sideline theme below the 1.1400 handle today, so far supported by the 1.1300 neighbourhood.

- The recent rejection from the 1.1400 level and beyond has motivated sellers to return to the market and once again open the door for a probable leg lower.

- Immediate support thus emerges at the 2018 low at 1.1214 (November 12) ahead of 1.1188, a Fibo retracement of the 2017-2018 rally.

EUR/USD daily chart

EUR/USD

Overview:

Today Last Price: 1.1325

Today Daily change: -20 pips

Today Daily change %: -0.176%

Today Daily Open: 1.1345

Trends:

Previous Daily SMA20: 1.1348

Previous Daily SMA50: 1.1427

Previous Daily SMA100: 1.152

Previous Daily SMA200: 1.1751

Levels:

Previous Daily High: 1.1362

Previous Daily Low: 1.1311

Previous Weekly High: 1.1402

Previous Weekly Low: 1.1267

Previous Monthly High: 1.15

Previous Monthly Low: 1.1216

Previous Daily Fibonacci 38.2%: 1.1342

Previous Daily Fibonacci 61.8%: 1.133

Previous Daily Pivot Point S1: 1.1317

Previous Daily Pivot Point S2: 1.1288

Previous Daily Pivot Point S3: 1.1266

Previous Daily Pivot Point R1: 1.1367

Previous Daily Pivot Point R2: 1.139

Previous Daily Pivot Point R3: 1.1418