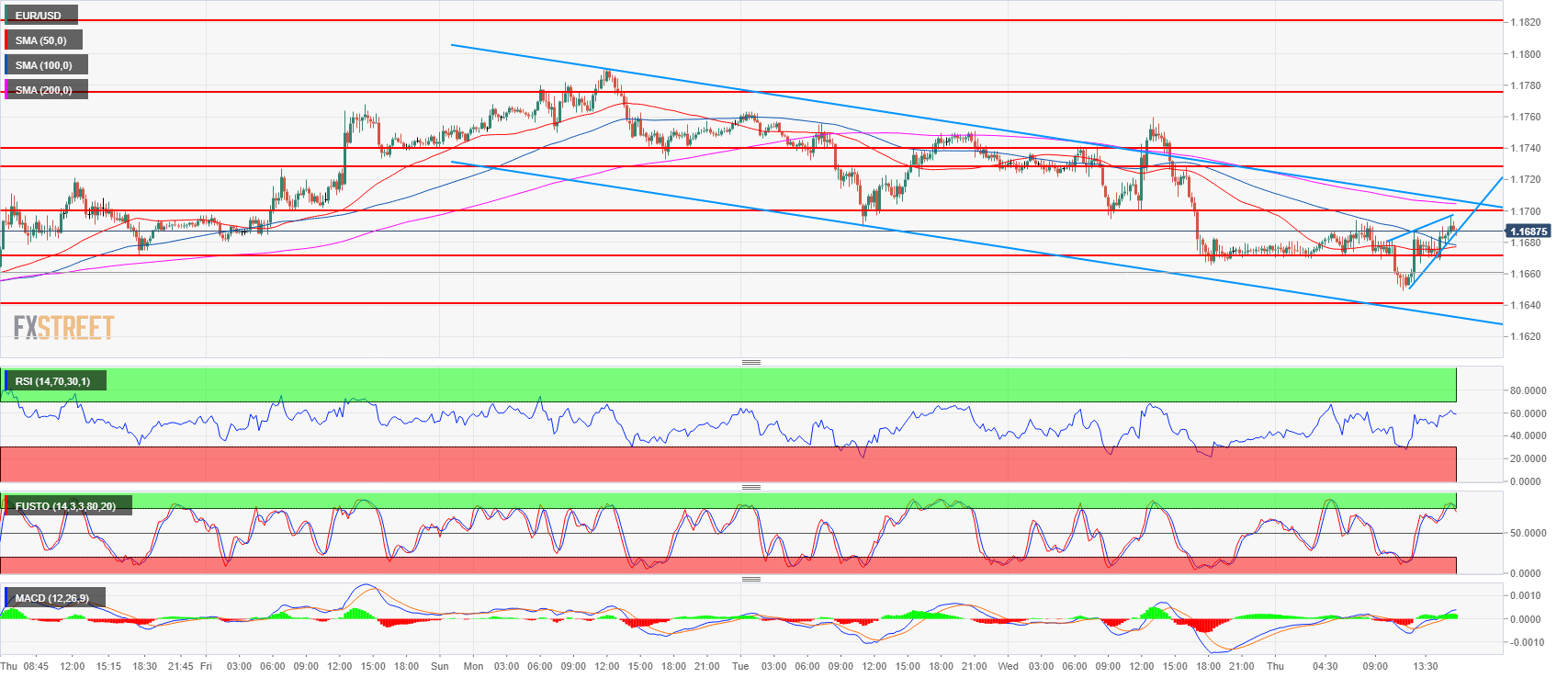

- EUR/USD is having a small pullback just below the 1.1700 level. The strength of the pullback is rather weak suggesting that bulls will need more in order to break through the level.

- In addition, EUR/USD bulls would need to break above the trendline and the 200-period simple moving average if they want to extend the current bullish reversal attempt.

- To the downside, the line in the sand for bears is the 1.1640, a break below the level would likely see an acceleration towards 1.1600. On the flip side, a strong breakout above 1.1700 can see a retest of the 1.1720-1.1730-1.1740 area, with the June 26 high, the 23.6% Fibonacci retracement from mid-April-May bear move and the weekly open, which is quite a lot of resistance to go through. A breakout above this area would be considered negative for bears.

EUR/USD 15-minute chart

Spot rate: 1.1685

Relative change: 0.10%

High: 1.1696

Low: 1.1649

Trend: Bearish

Resistance 1: 1.1700 figure

Resistance 2: 1.1720-1.1730-1.1740 area, June 26 high, 23.6% Fibonacci retracement from mid-April-May bear move and weekly open.

Resistance 3: 1.1775 supply level

Resistance 4: 1.1800 figure

Resistance 5: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672 June 27 high

Support 2: 1.1640 supply/demand level

Support 3: 1.1600 figure

Support 4: 1.1560 June 14 low

Support 5: 1.1508 current 2018 low