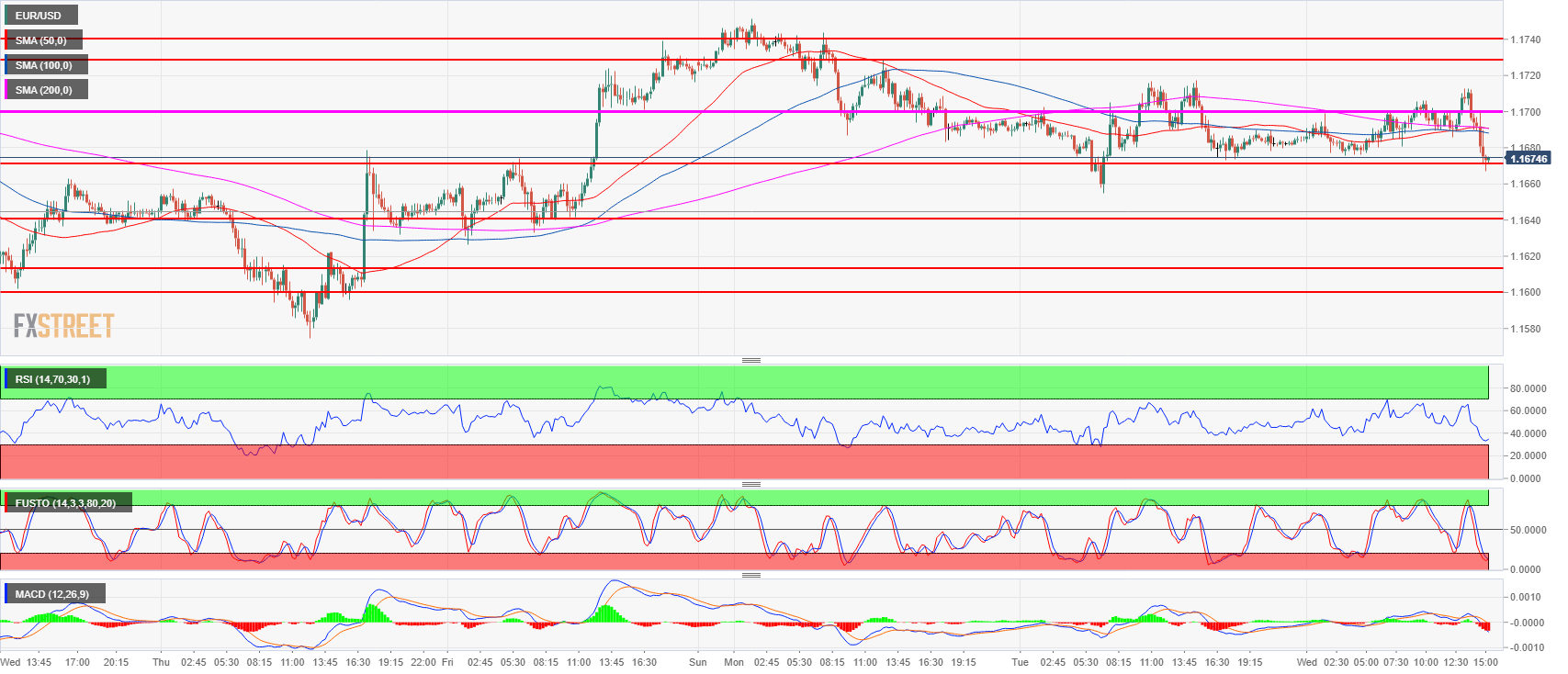

- EUR/USD lost bullish momentum has it found strong selling interest just above the 1.1710 level.

- EUR/USD is now erasing the daily gains and en route to challenge the weekly low at 1.1653.

- EUR/USD short-term bias has now switched in favor of the bears as EUR/USD is trading below its main simple moving averages. However, it remains to be seen if the bears can sustain the bearish momentum throughout the day. The 1.1654 level will be the strongest hurdle to overcome followed by the 1.1640-1.1649 area.

EUR/USD 15-minute chart

Spot rate: 1.1673

Relative change: -0.11%

High: 1.1712

Low: 1.1667

Trend: Bearish

Resistance 1: 1.1730-1.1740 area, 23.6% Fibonacci retracement mid-April-May bear move, key level.

Resistance 2: 1.1760-1.1795 supply level

Resistance 3: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672-1.1700 June 27 high and figure

Support 2: 1.1654 current weekly low

Support 3: 1.1640-1.1649 area, key level and July 12 low

Support 4: 1.1600-1.1613 figure and July 13 low

Support 5: 1.1560 June 14 low

Support 6: 1.1508 current 2018 low