- EUR/USD started the week with a 64-pip move down from current daily high to low. EUR/USD found buying interest near the 1.1700 figure and is now trading above the level.

- As the American session started, investors are debating whether to continue the main bearish trend on EUR/USD by breaking below 1.1672-1.1700 area; or attempting a reversal up by first breaking 1.1730-1.1740 area in order to first reach 1.1760-1.1795 area.

- Although the main trend is bearish, bullish pressure is mounting and a failure for bears to regain 1.1672-1.1700 can leave to room open to further advance towards the 1.1730-1.1740 area and beyond. At the time of writing, the bulls have a slight advantage while above 1.1672-1.1700.

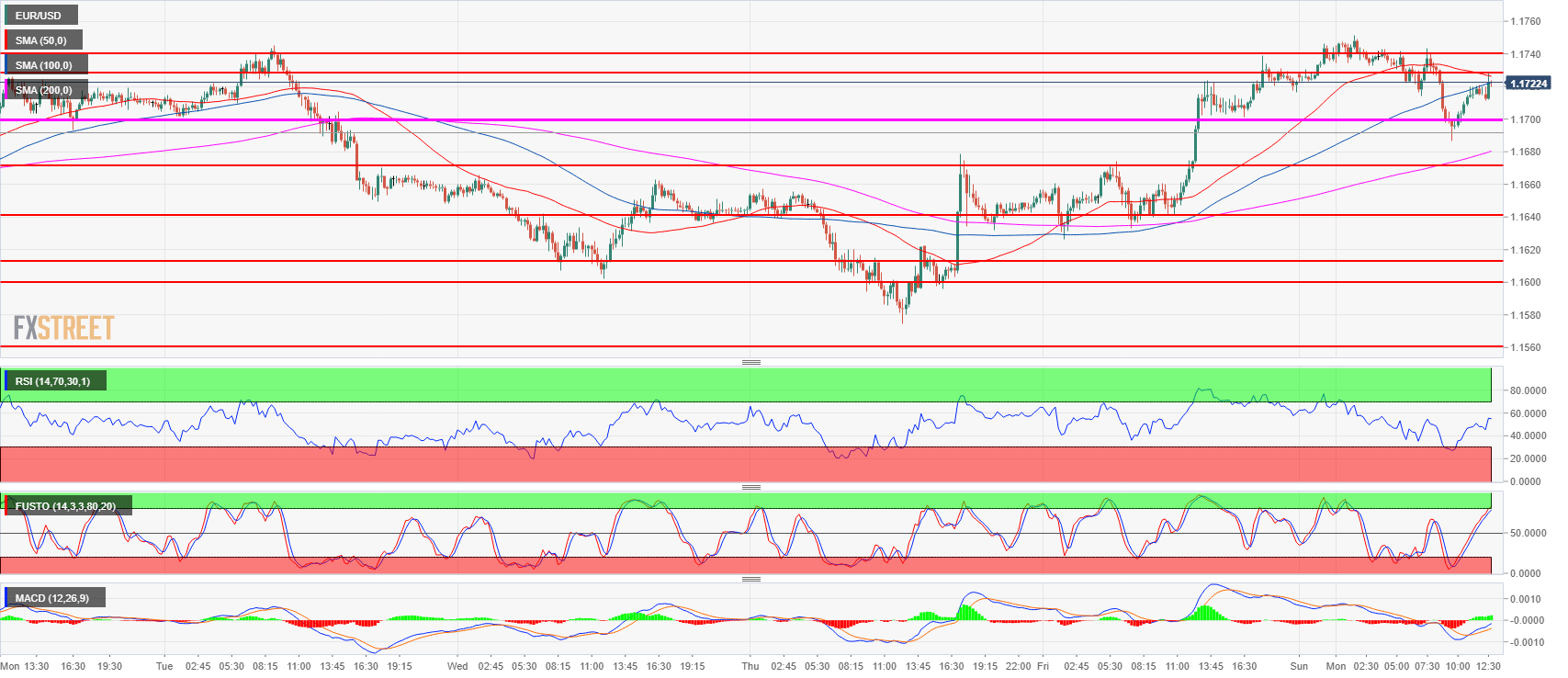

EUR/USD 15-minute chart

Spot rate: 1.1720

Relative change: -0.02%

High: 1.1751

Low: 1.1686

Trend: Bearish / Bullish reversal attempt

Resistance 1: 1.1730-1.1740 area, 23.6% Fibonacci retracement from mid-April-May bear move and last week’s open.

Resistance 2: 1.1760-1.1795 supply level

Resistance 3: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672-1.1700 June 27 high and figure

Support 2: 1.1640-1.1649 area, key level and July 12 low

Support 3: 1.1600-1.1613 figure and last week’s low

Support 4: 1.1560 June 14 low

Support 5: 1.1508 current 2018 low

Support 6: 1.1400 figure