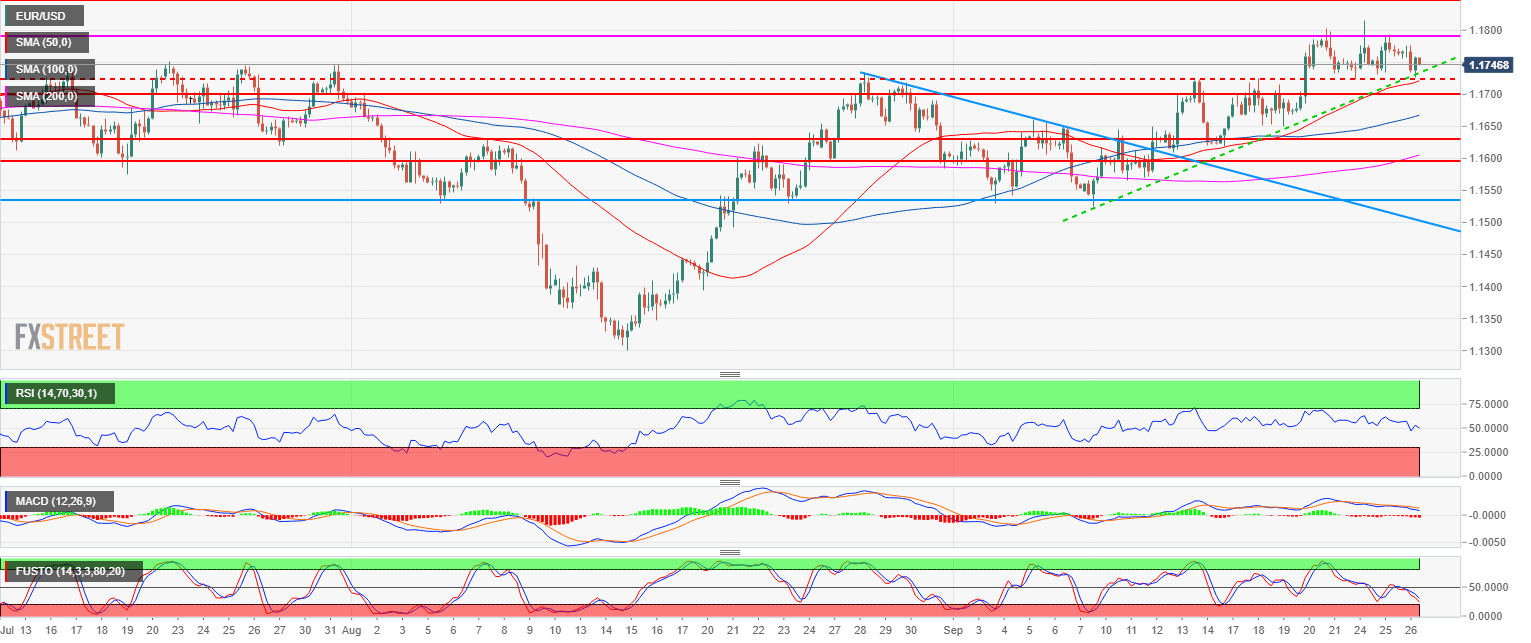

- EUR/USD main bear trend is switching to bullish as EUR/USD is trading above its 100-day simple moving average.

- EUR/USD found support at the 1.1723 support and rebounded near 1.1750. EUR/USD is trading well above its 50, 100 and 200-period simple moving averages while the RSI, MACD and Stochastics indicators are slowing down. EUR/USD is also supported by the bull trendline (green). Upside targets are located near 1.1800 and 1.1853 (June 14 high).

- The bullish bias remains intact ahead of the FOMC. However, the event can potentially lead to extreme volatility on the currency pair.

Spot rate: 1.1745

Relative change: -0.18%

High: 1.1776

Low: 1.1725

Main trend: Bullish

Resistance 1: 1.1750 key resistance (July)

Resistance 2: 1.1800 figure

Resistance 3: 1.1853 June 14 high

Resistance 4: 1.1900 figure

Support 1: 1.1723 September 24 low

Support 2: 1.1654 August 27 high

Support 3: 1.1630 August 8 high key level

Support 4: 1.1600 figure

Support 5: 1.1572 July 19 low

Support 6: 1.1542 supply/demand level

Support 7: 1.1530 August 23 swing low

Support 8: 1.1508 June 8 low