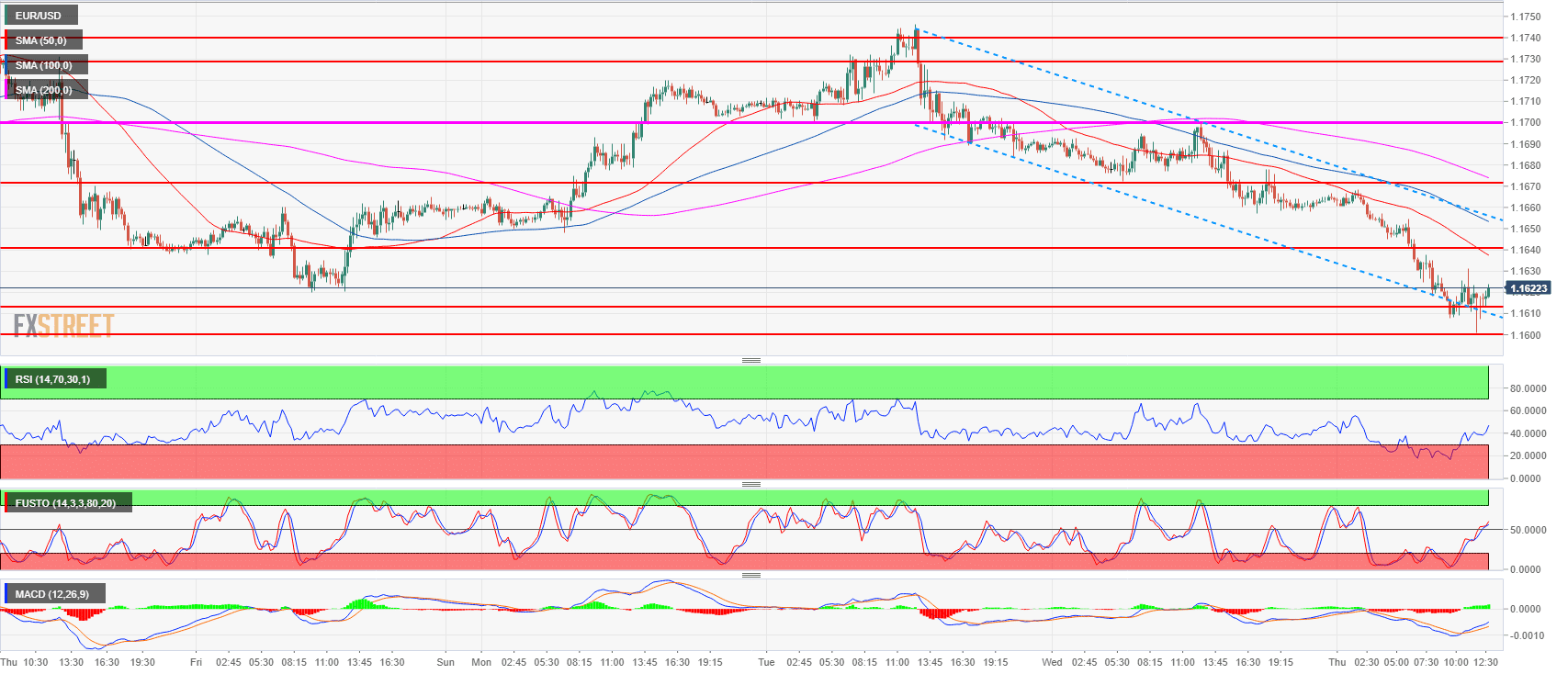

- EUR/USD lost about 45 pips from Asia as the market is now stalling just above the 1.1600 figure.

- Bulls will try to lift the market from the 1.1600 figure in order to reclaim the 1.1640 level, while bear need a breakout below the 1.1600 level which could open the gates to the 1.1574 July 19 low.

- Bulls would need to breakout above 1.1630-40 in order to have a credible bottom.

EUR/USD 15-minute chart

Spot rate: 1.1622

Relative change: -0.32%

High: 1.1668

Low: 1.1601

Trend: Bearish / Bullish pullback above 1.1630-40

Resistance 1: 1.1640-1.1649 area, key level and July 12 low

Resistance 2: 1.1672 June 27 high

Resistance 3: 1.1700 figure

Resistance 4: 1.1730-1.1740-1.1750 area, 23.6% Fibonacci retracement mid-April-May bear move, figure.

Resistance 5: 1.1760-1.1795 supply levels

Resistance 6: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1600-1.1613 figure and July 13 low

Support 2: 1.1574 July 19 low

Support 3: 1.1527 June 26 low

Support 4: 1.1508 current 2018 low