- EUR/USD has been driven to its daily lows during and after the European Central Bank (ECB) press conference. Mario Draghi, the ECB’s President sees no need to modify guidance on rates. Additionally, there is no change in outlook for inflation and growth and no new monetary policy message.

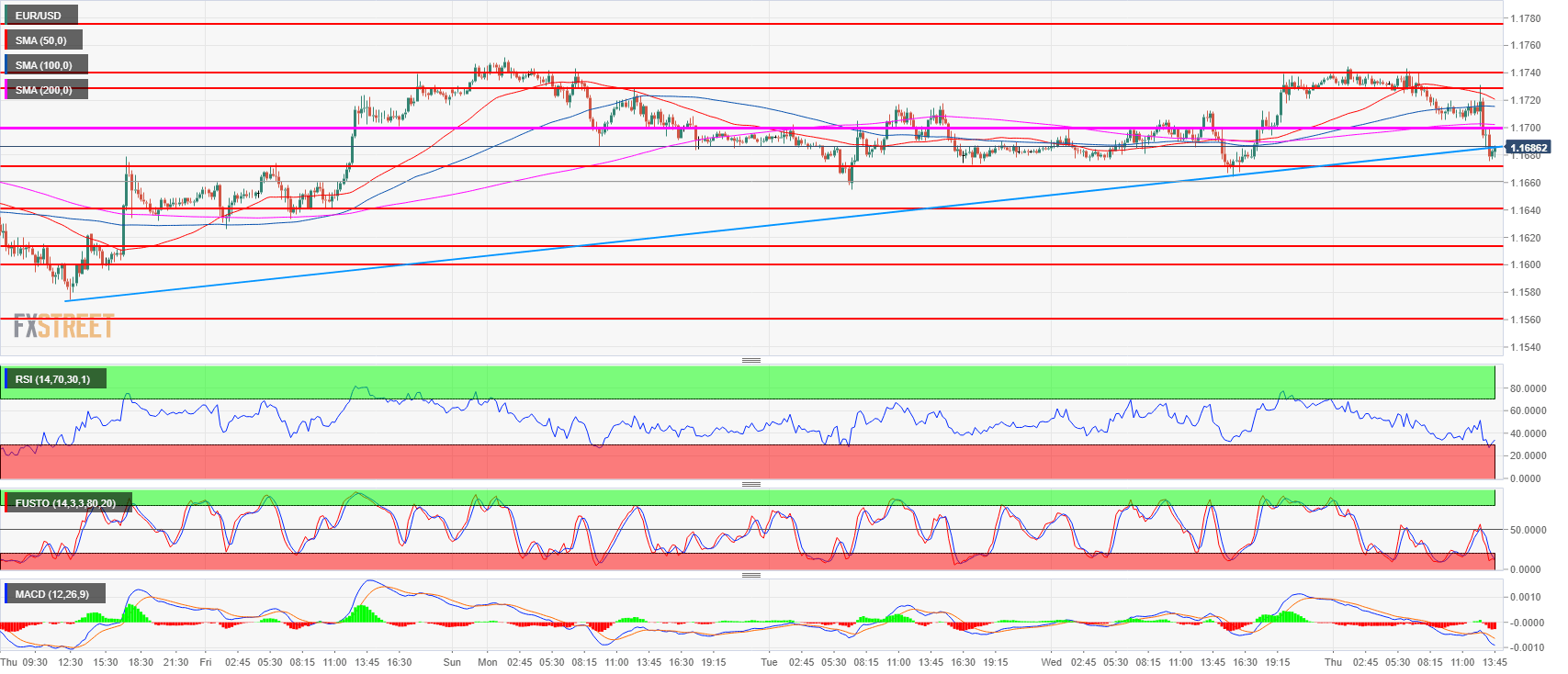

- EUR/USD is currently trading just above 1.1672 support. The recent drop hasn’t broken below Wednesday’s lows or any significant support that would put the current bull leg in peril. On that basis, sideways to up price action can be expected after the ECB-driven 50-pip move down. Bulls will need to regain 1.1700 while bears will try to break below 1.1672.

Spot rate: 1.1685

Relative change: 0.37%

High: 1.1744

Low: 1.1673

Trend: Bearish / Risk of trend reversal above 1.1730-1.1750

Resistance 1: 1.1700 figure

Resistance 2: 1.1730-1.1740-1.1750 area, 23.6% Fibonacci retracement mid-April-May bear move, weekly high.

Resistance 3 1.1760-1.1795 supply levels

Resistance 4: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672 June 27 high

Support 2: 1.1654 current weekly low

Support 3: 1.1640-1.1649 area, key level and July 12 low

Support 4: 1.1600-1.1613 figure and July 13 low

Support 5: 1.1560 June 14 low

Support 6: 1.1508 current 2018 low