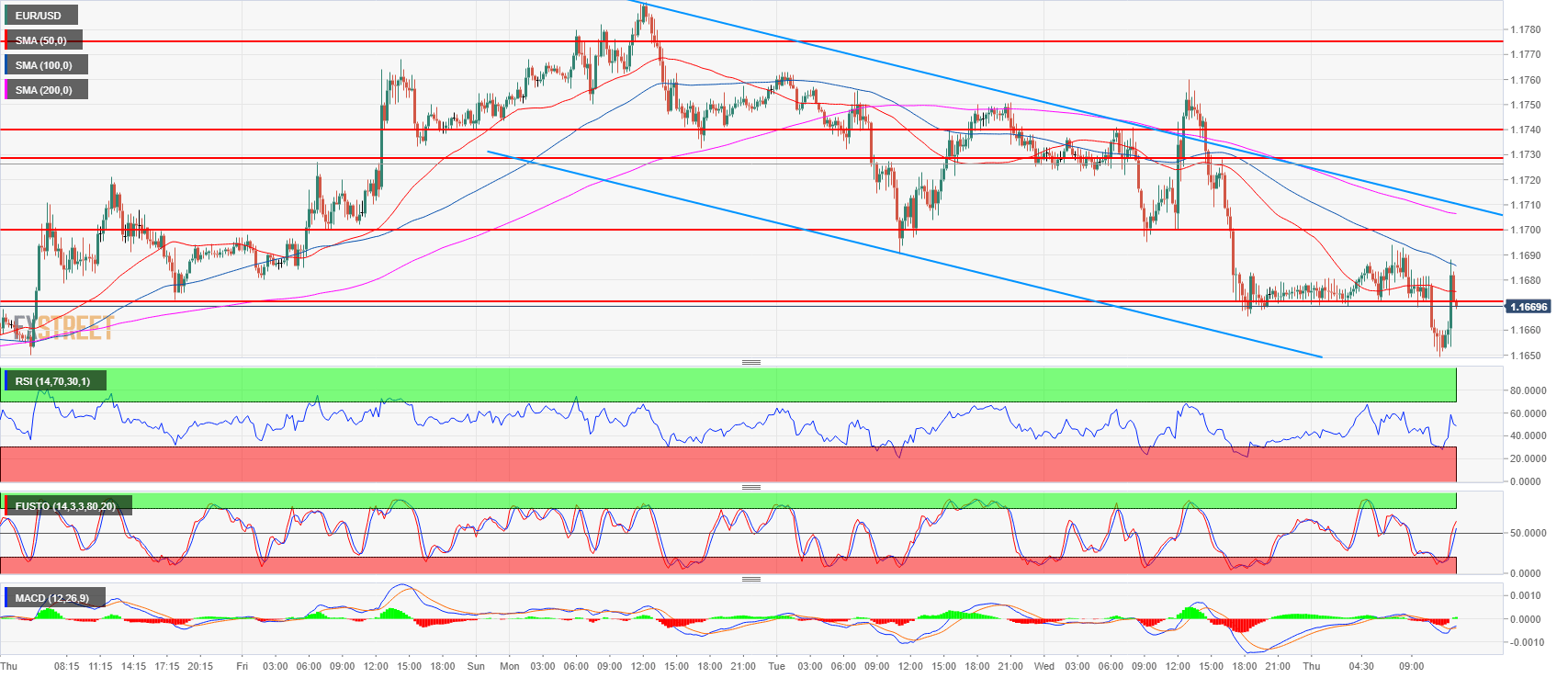

- EUR/USD is having a 30-pip boost from daily lows after the US Consumer Price Index (CPI) came in line with expectations at 2.3% in June.

- At the time of writing the bull breakout seems to be short-lived as the market is rejecting the 100-period simple moving average. However the picture remains unclear just after the news release as market participants are repositioning themselves. Technicals suggest a continuation of the drift lower as long as the market stays below 1.1700.

- Earlier in Europe, the European Central Bank minutes sounded rather dovish weighing on the Euro.

EUR/USD 15-minute chart

Spot rate: 1.1673

Relative change: 0.02%

High: 1.1694

Low: 1.1649

Trend: Bearish

Resistance 1: 1.1700 figure

Resistance 2: 1.1730-1.1740 23.6% Fibonacci retracement from mid-April-May bear move and weekly open.

Resistance 3: 1.1775 supply level

Resistance 4: 1.1800 figure

Resistance 5: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672 June 27 high

Support 2: 1.1640 supply/demand level

Support 3: 1.1600 figure

Support 4: 1.1560 June 14 low

Support 5: 1.1508 current 2018 low