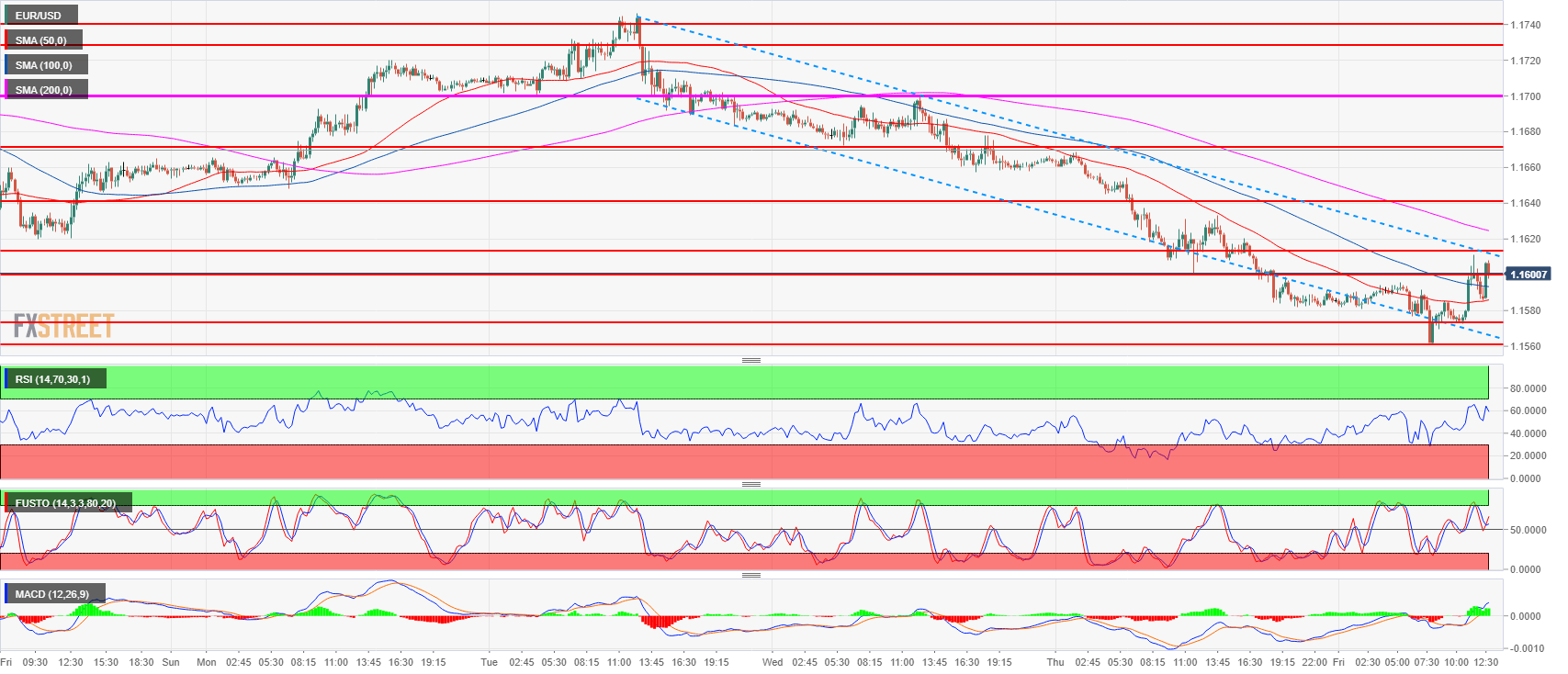

- EUR/USD is currently having a small bullish reaction after the US Nonfarm Payrolls came in worse-than-expected at 157K versus 190K forecast while the Average Hourly Earnings in July annualized came in line at 2.7%.

- After finding support at 1.1562 in early Europe, EUR/USD is now attempting to keep its gains above the 1.1600 level in order to reach the 200-period simple moving average and the 1.1640 level. Buyers have a fair chance in creating a bullish reversal but they would need to break above the 200 SMA and 1.1640 in order to eliminate the risk of the bear trend resumption.

- Sellers are working hard in order to maintain the market below 1.1600 but as the market is trading above the 50 and 100 SMA, bulls have for the moment a slight advantage.

EUR/USD 15-minute chart

Spot rate: 1.1601

Relative change: 0.15%

High: 1.1611

Low: 1.1561

Trend: Bearish / Bullish pullback

Resistance 1: 1.1640-1.1649 area, key level and July 12 low

Resistance 2: 1.1672 June 27 high

Resistance 3: 1.1700 figure

Resistance 4: 1.1730-1.1740-1.1750 area, 23.6% Fibonacci retracement mid-April-May bear move, figure.

Resistance 5: 1.1760-1.1795 supply levels

Resistance 6: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1600-1.1613 figure and July 13 low

Support 2: 1.1574 July 19 low

Support 3: 1.1527 June 26 low

Support 4: 1.1508 current 2018 low