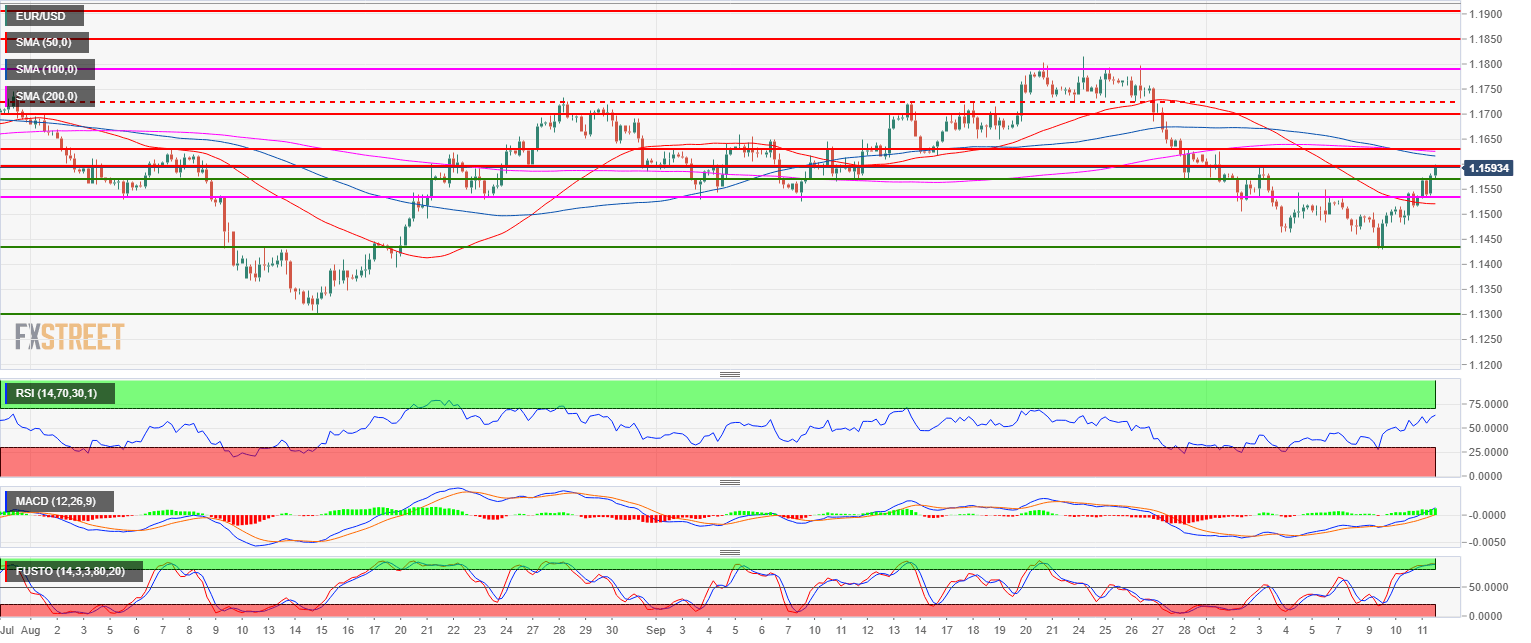

- EUR/USD is currently having a reversal up since Monday. Freshly released the US Consumer Price Index Ex Food & Energy year-on-year for September missed expectations at 2.2% versus 2.3% forecast. The data is weakening the USD and giving EUR/USD extra boost.

- EUR/USD bias remains bullish as the market is now challenging the 1.1600 figure. The next targets are seen near 1.1630 August (8 high key level) and 1.1654 (August 27 high). The RSI, MACD and Stochastic indicators remain constructive to the upside.

- A bear breakout below 1.1530 would likely invalidate the current bullish bias.

Spot rate: 1.1583

Relative change: 0.59%

High: 1.1599

Low: 1.1517

Main trend: Bearish

Short-term trend: Bullish

Resistance 1: 1.1600 figure

Resistance 2: 1.1630 August 8 high key level

Resistance 3: 1.1654 August 27 high

Support 1: 1.1569 Sept. 28 low

Support 2: 1.1530 August 23 swing low

Support 3: 1.1500 figure and October 2 swing low

Support 4: 1.1463 October 4 low

Support 5: 1.1430 October 9 low