- US Non-farm Payrolls (NFP) disappoints with only 130K jobs vs. 158K forecast.

- Average Hourly Earnings beat expectations with 3.2% vs. 3.1% forecast.

- EUR/USD is challenging daily highs near the 1.1050 price level.

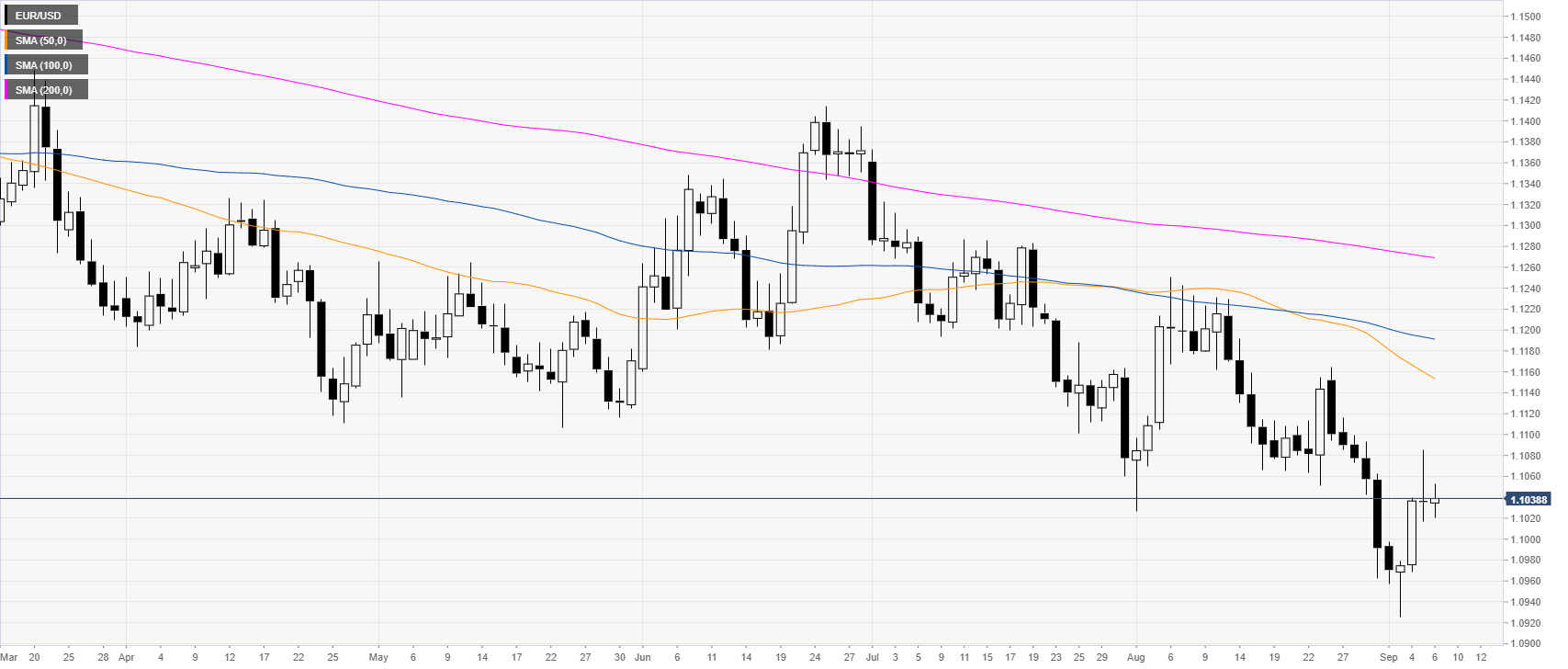

EUR/USD daily chart

On the daily time-frame, the common currency is trading in a bear trend below its main daily simple moving averages (DSMAs). This Friday, the US Non-farm Payrolls (NFP) in the United States (US) came in below expectations with only 130K jobs added in August vs. 158K forecast. However, the wages, the Average Hourly Earnings beat expectations with 3.2% vs. 3.1% forecast. The reaction was a small dip in the US Dollar and a 20-pip move up on the EUR/USD currency pair.

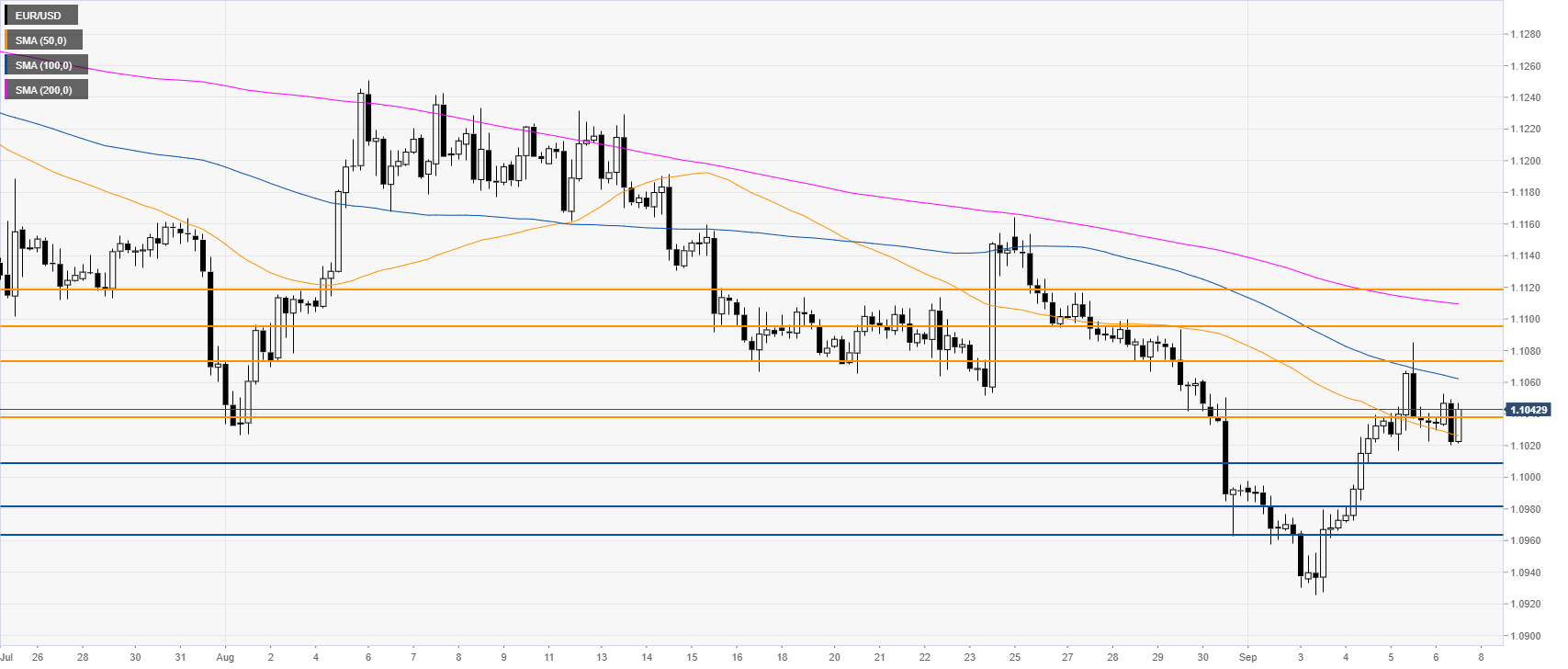

EUR/USD four-hour chart

EUR/USD is challenging 1.1038 resistance while trading below the 100 and 200 SMAs. The bulls seem unconvinced buts sellers need to overcome 1.1009 support to drive the market towards 1.0981 and 1.1063 support levels, according to the Technical Confluences Indicator.

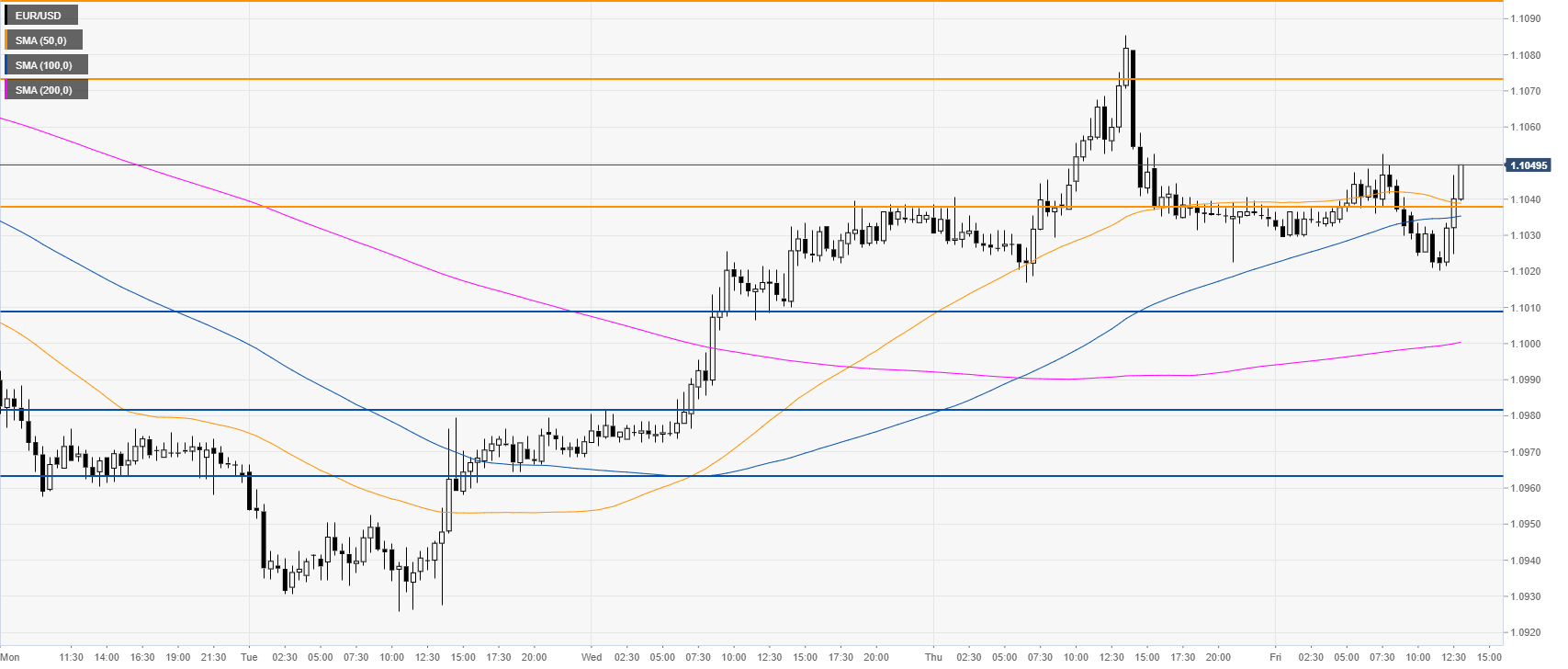

EUR/USD 30-minute chart

EUR/USD is trading just above the 1.1038 level and the main SMAs, suggesting bullish momentum in the near term. However, bulls will need to reclaim 1.1073 resistance if they intend to resume the recovery started last Tuesday.

Additional key levels