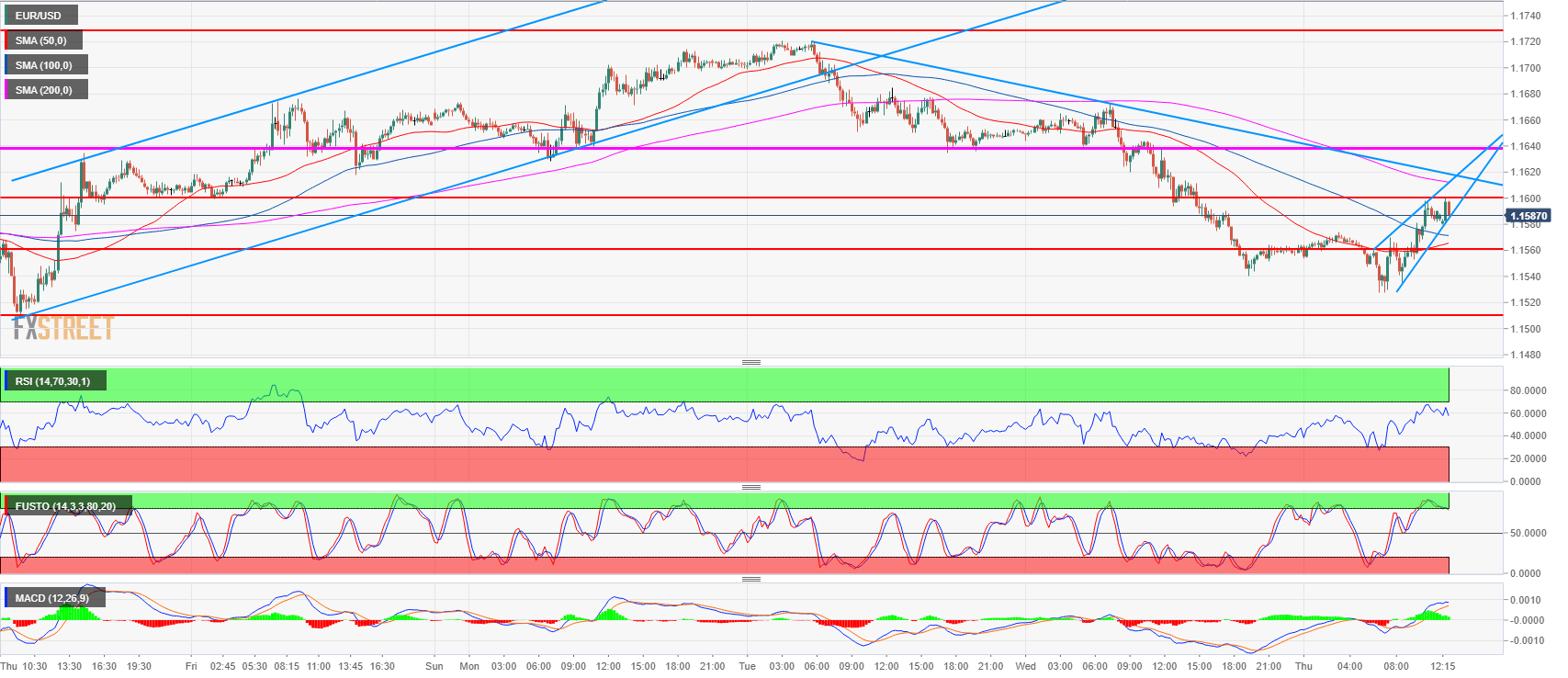

- EUR/USD is stalling below the 1.1600 figure after the release of the US Gross Domestic Product and the Personal Consumption Expenditure, the data came in mixed.

- EUR/USD is attempting to reverse the current bear trend as it found a floor near the 1.1500 level earlier in Europe. It is now trapped in a bearish wedge.

- A failure to break above 1.1600 can lead to e resumption of the bear trend.

Spot rate: 1.1581

Relative change: 0.30%

High: 1.1600

Low: 1.1527

Trend: Bearish

Resistance 1: 1.1600 figure

Resistance 2: 1.1634 Monday’s low

Resistance 3: 1.1685 Monday intraday swing high

Resistance 4: 1.1700 figure

Resistance 5: 1.1730, 23.6% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1560 June 14 low

Support 2: 1.1508 current 2018 low

Support 3: 1.1431 weekly 100-period simple moving average