- EUR/USD spike to September highs as the ECB is cutting rates and announcing QE in November.

- Friday will be key as the market will decide if Thursday’s spike is an over-reaction or the start of a recovery.

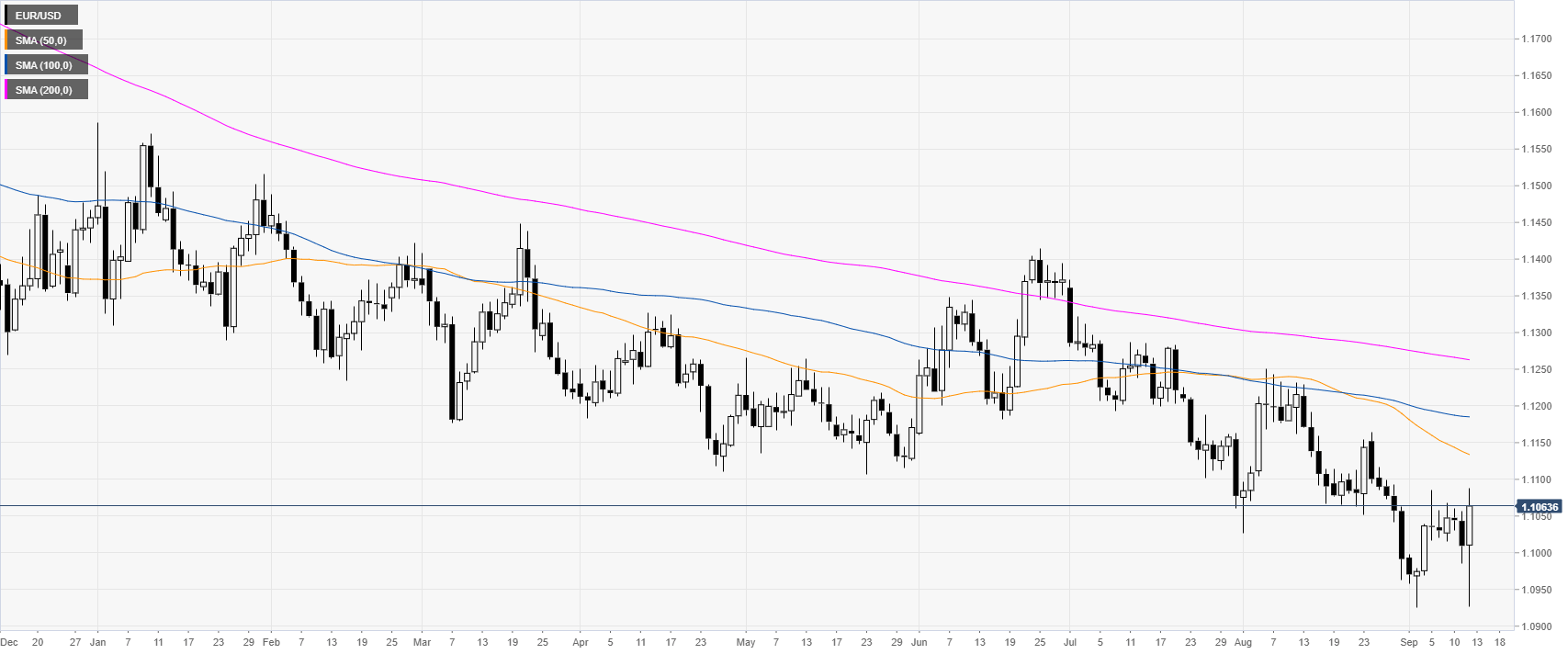

EUR/USD daily chart

On the daily time-frame, the common currency is trading in a bear trend below the main daily simple moving averages (DSMAs). Earlier on Thursday, the European Central Bank’s (ECB) has cut interest rates by 0.1% and announced an open-ended Quantitive Easing (QE).

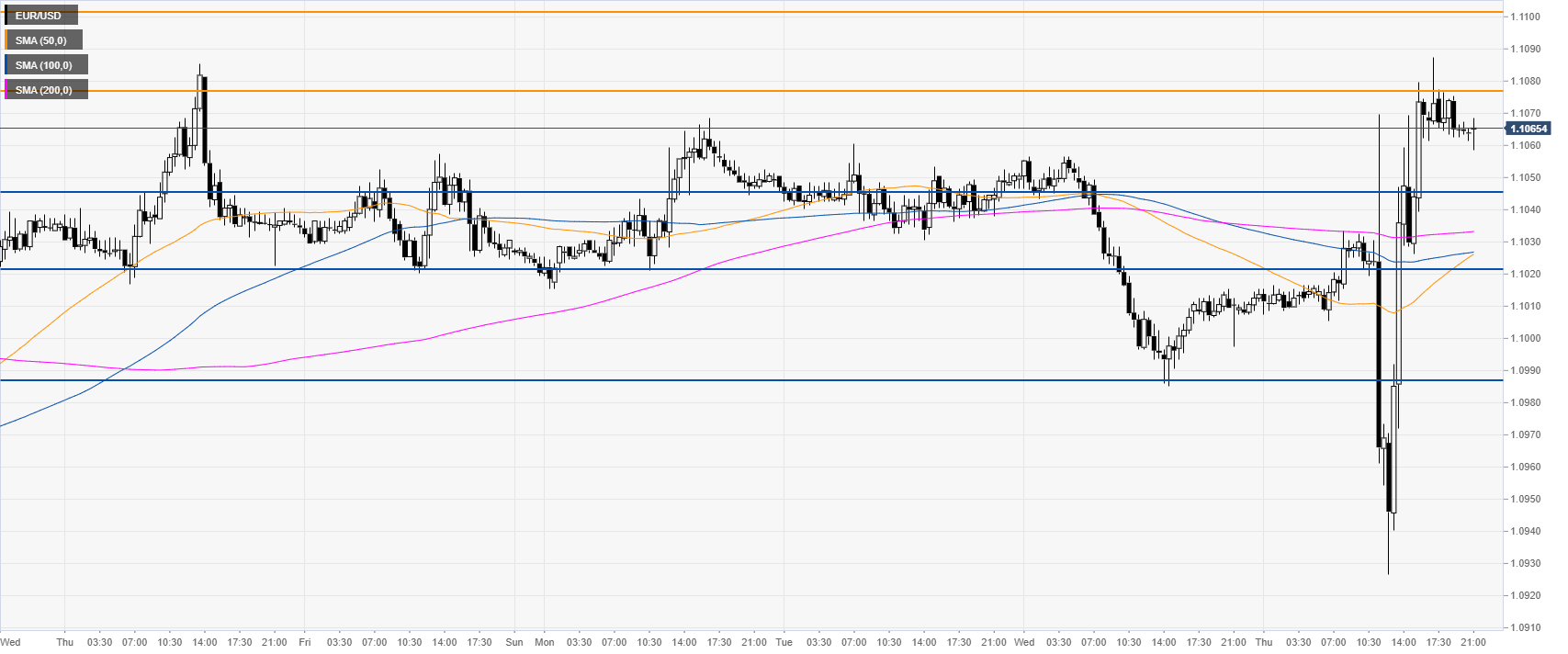

EUR/USD four-hour chart

The Fiber had a massive spike up to the 1.1075 resistance regaining the 50 and 100 SMAs. This Friday, it will be interesting to see if the bulls can push EUR/USD above the current September high near the 1.1075 resistance. The next resistances on the way up are seen at the 1.1103 and 1.1143 level, according to the Technical Confluences Indicator.

EUR/USD 30-minute chart

The 1.1075 is a significant resistance. If the market fails to build on the recent spike, the market can start to pullback down towards 1.1048, 1.1023 and 1.0988 support levels.

Additional key levels