- The US Gross Domestic Product this Thursday keeps the Euro under pressure.

- In the New York session, the Fiber had a bullish spike which spanned the whole daily range after comments from ECB’s Knot.

- The level to beat for bears is the 1.1052 support followed by the 1.1033 level.

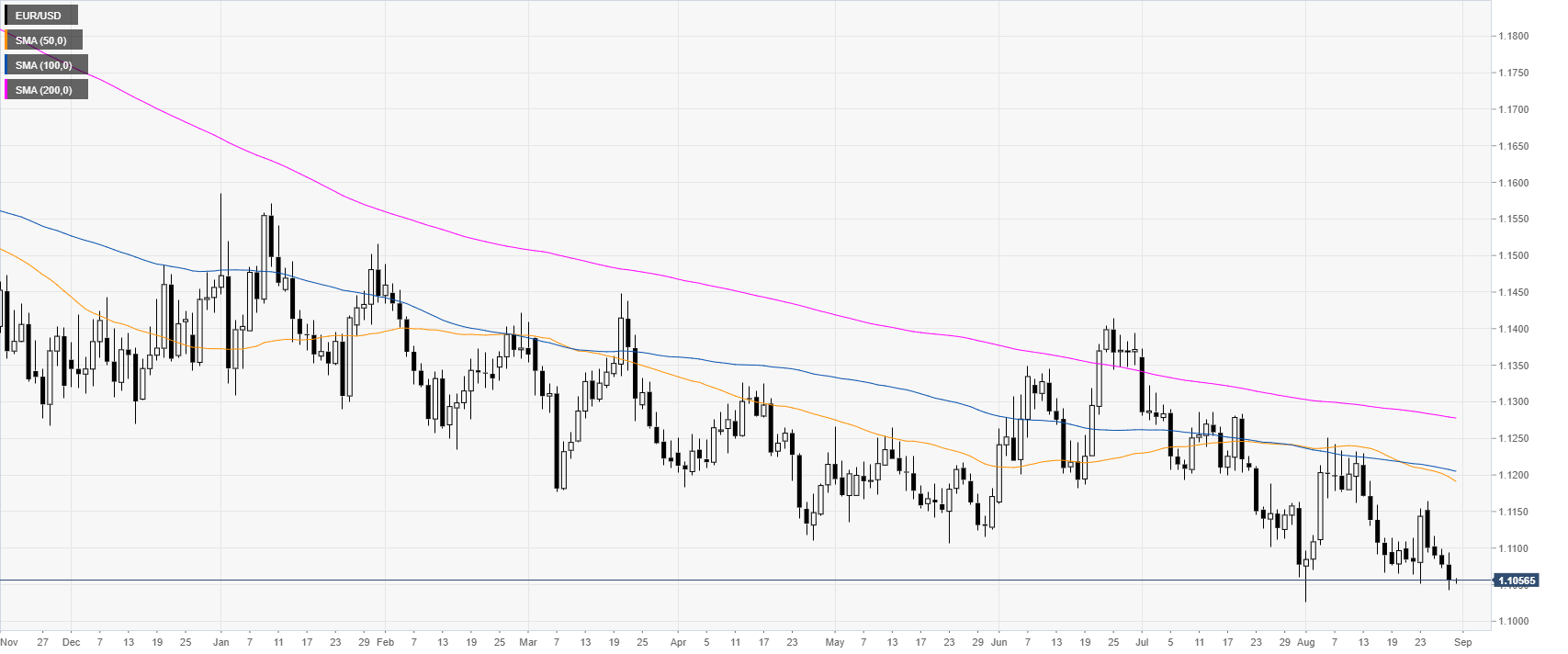

EUR/USD daily chart

On the daily time-frame, the common currency is trading in a bear trend below the main daily simple moving averages (DSMAs). Earlier in the New York session, the US Gross Domestic Product Annualized (GDP) came in line with expectations at 2% in the second quarter. In the London session, the German inflation in August (YoY) came below expectations at 1% vs. 1.2% forecast by analysts.

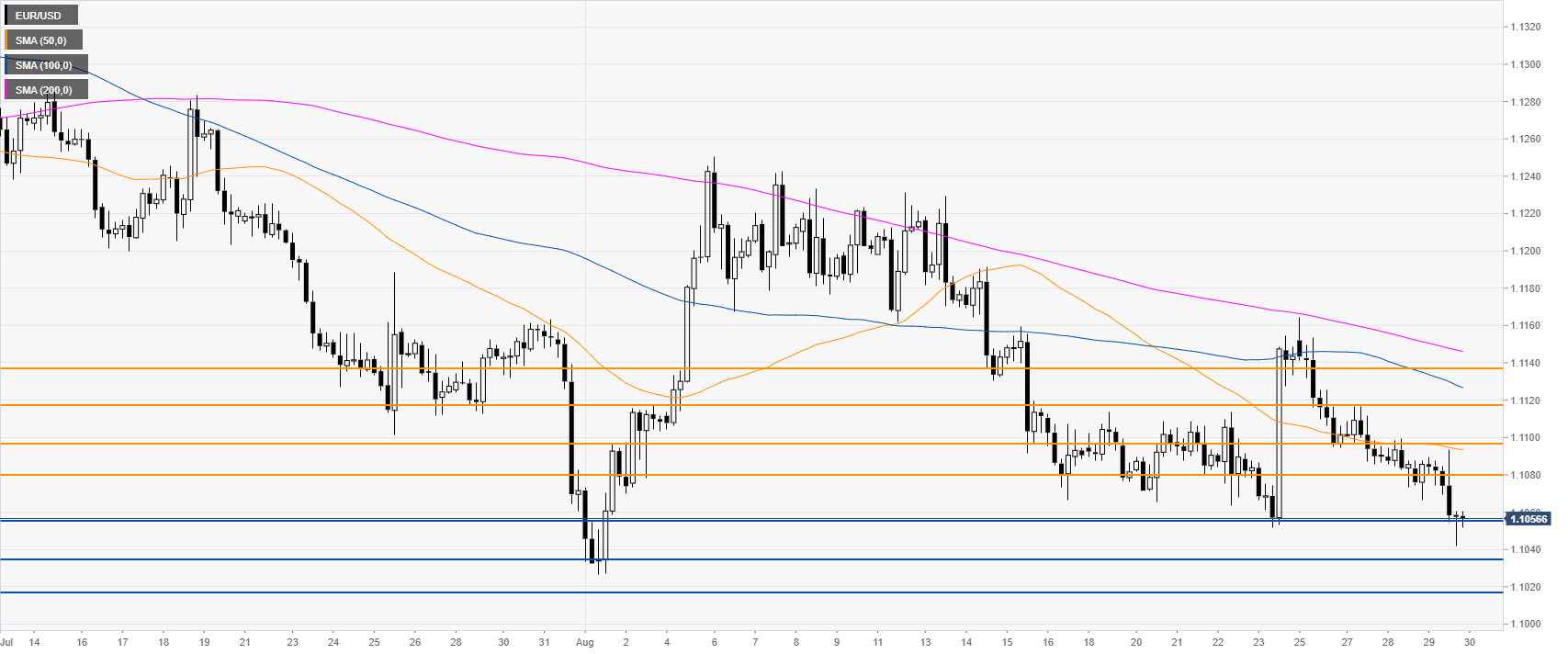

EUR/USD 4-hour chart

The Euro is under bearish pressure below the main SMAs as the market reached new weekly lows this Thursday. The Fiber broke below the 1.1052 support; however, it retraced back above it into the New York close. The potential for a move down towards 1.1033 and 1.1016 levels is still on the cards, according to the Technical Confluences Indicator.

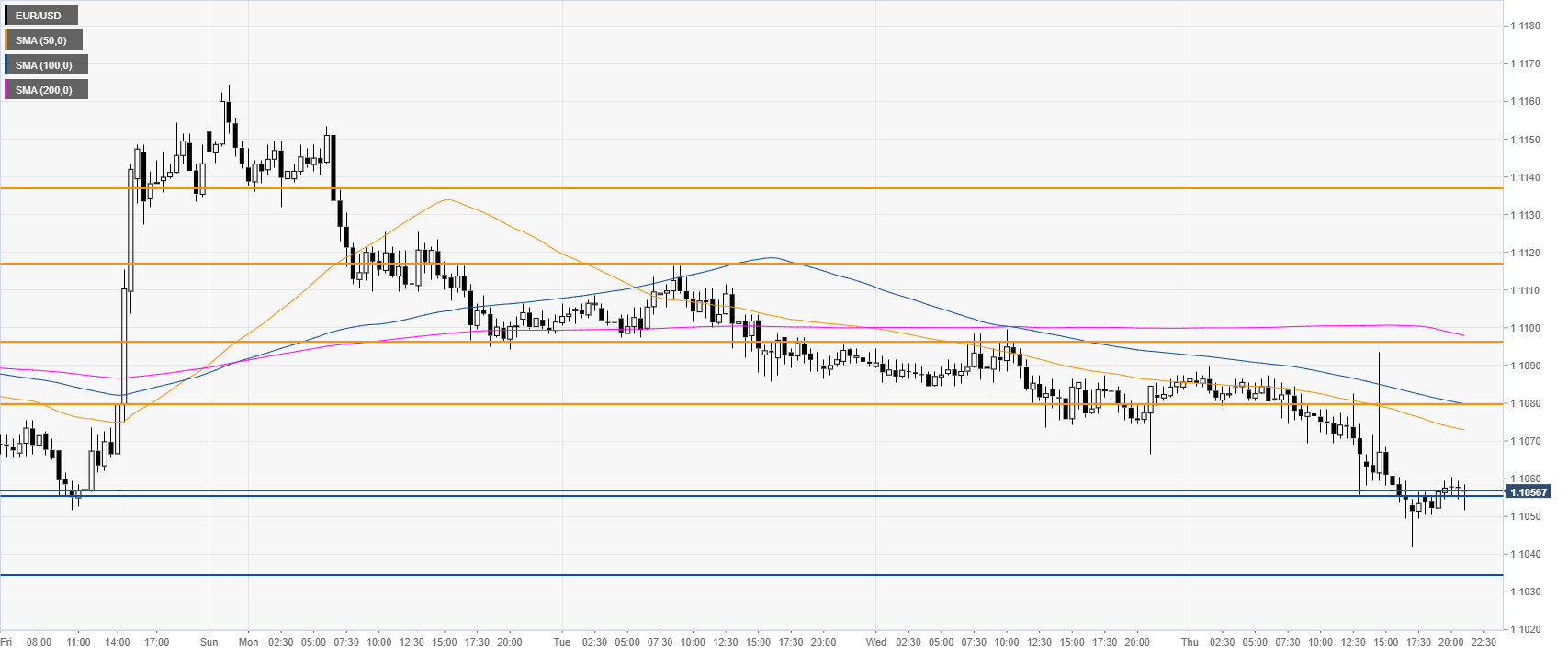

EUR/USD 30-minute chart

EUR/USD is trading below the main SMAs, suggesting a bearish momentum in the near term. Immediate resistances are seen at 1.1080, 1.1098 and 1.1117 levels, according to the Technical Confluences Indicator. Earlier in the New York session, the Fiber had a bullish spike which covered the whole daily range in two minutes only to be retraced afterward. ECB’s Knot said there was “no need to resume a Quantitative Easing program” and “the ECB’s September meeting exactions are overdone.”

Additional key levels