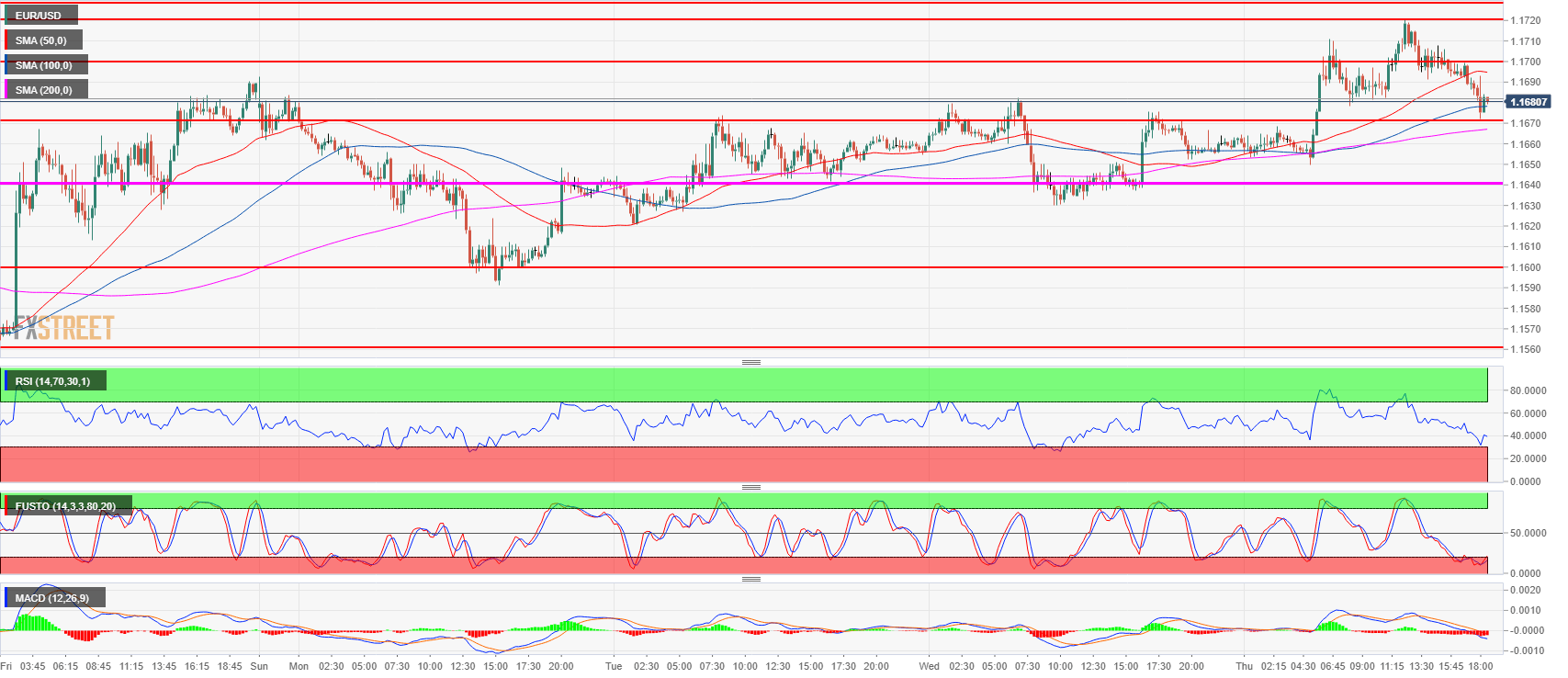

- EUR/USD had virtually no reaction following the release of the FOMC meeting minutes.

- EUR/USD has retraced 61.8% from daily low to high suggesting that some investors who missed the bull breakout in early Europe might be buying near those levels.

- On the other hand, bears see the bullish advance of the last five days as a bull flag in a bear trend and are willing to short near the 1.1700-1.1730 area. A bull breakout above the level might lead to bear capitulation and a move towards 1.1854, the 38.2% Fibonacci retracement from the mid-April-May bear move.

Spot rate: 1.1675

Relative change: 0.16%

High: 1.1721

Low: 1.1649

Trend: Bearish sub 1.1700-1.1730

Resistance 1 1.1700-1.1720 figure and last week’s high

Resistance 2: 1.1730, 23.6% Fibonacci retracement from mid-April-May bear move

Resistance 3: 1.1800 figure

Resistance 4: 1.1854, 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672 June 27 high

Support 2: 1.1640 supply/demand level

Support 3: 1.1600 figure

Support 4: 1.1560 June 14 low

Support 5: 1.1527 last week’s low

Support 6: 1.1508 current 2018 low