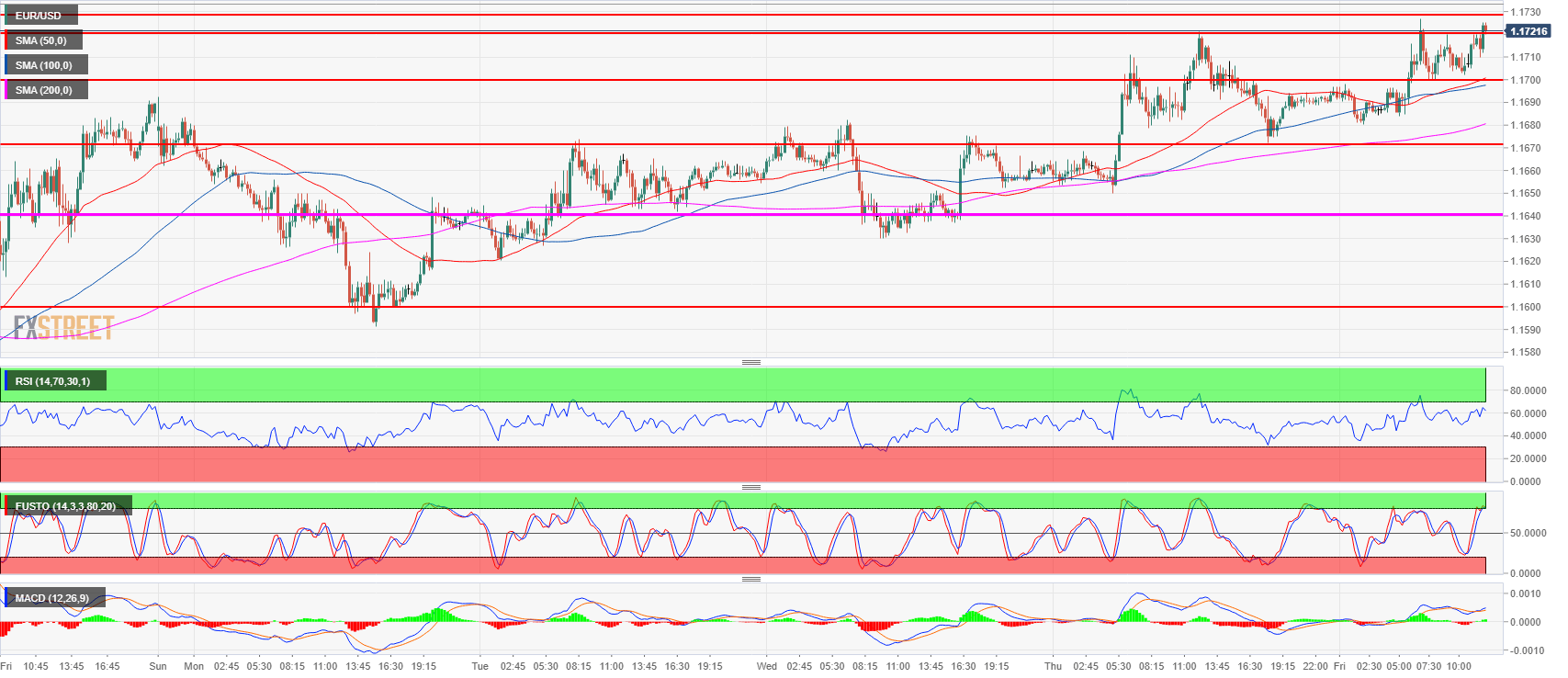

- EUR/USD is trading near its daily highs just below 1.1730, the 23.6% Fibonacci retracement from the mid-April-May bear move, ahead of the US Non-Farm Payrolls and Avearge Hourly Earnings at 12:30 GMT.

- A bull breakout above the level might lead to bear capitulation and a move towards 1.1854, the 38.2% Fibonacci retracement from the mid-April-May bear move.

- On the other hand, a failure to break above 1.1730 can lead to a rotation down towards the 1.1600 figure.

EUR/USD 15-minute chart

Spot rate: 1.1724

Relative change: 0.29%

High: 1.1727

Low: 1.1680

Trend: Neutral

Resistance 1 1.1700-1.1720 figure and last week’s high

Resistance 2: 1.1730, 23.6% Fibonacci retracement from mid-April-May bear move

Resistance 3: 1.1800 figure

Resistance 4: 1.1854, 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672 June 27 high

Support 2: 1.1640 supply/demand level

Support 3: 1.1600 figure

Support 4: 1.1560 June 14 low

Support 5: 1.1527 last week’s low

Support 6: 1.1508 current 2018 low