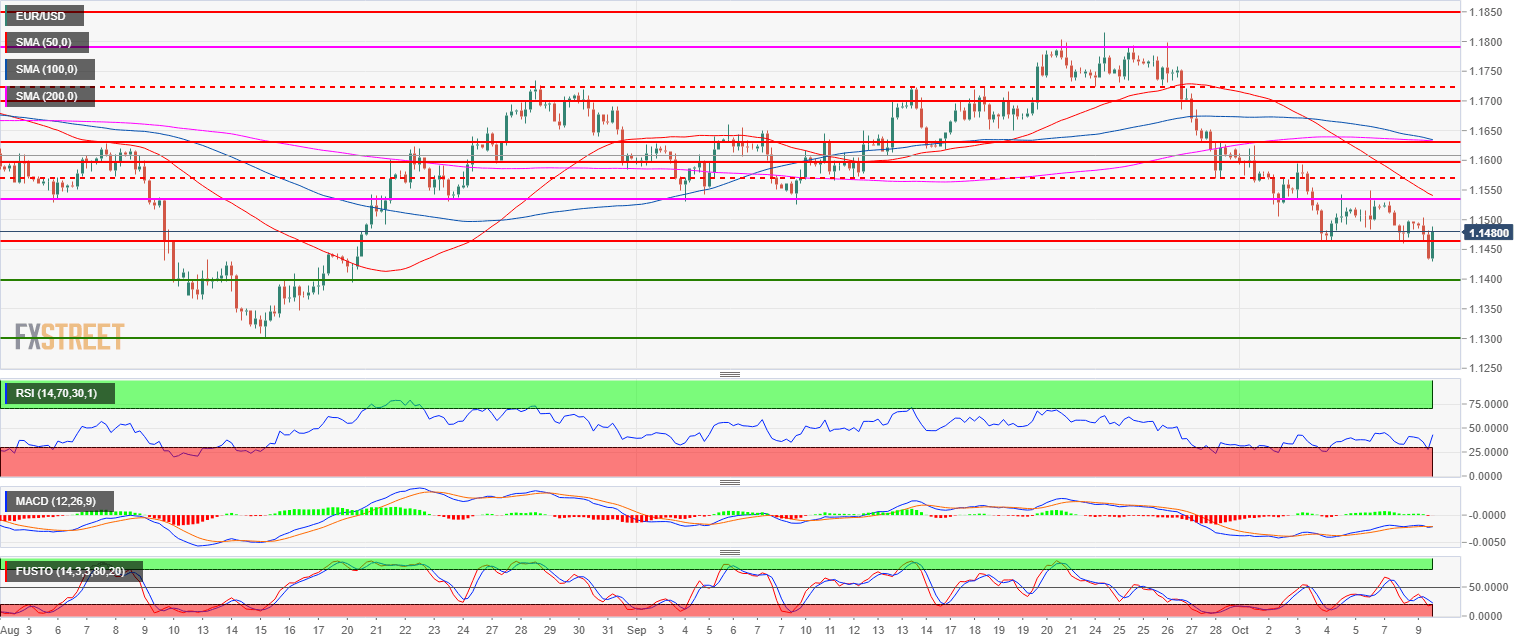

- EUR/USD is trading in a bear leg below its 50, 100 and 200-period simple moving average.

- EUR/USD erased the losses made earlier in the day as the market reintegrated last week low at 1.1463. Technically EUR/USD remains bearish as the market is making lower lows and lower highs. The move up this Tuesday seems to be exhausted at this stage.

- The strong reintegration of the 1.1463 is a sign of bearish weakness and the market might be transitioning to a range phase in the coming sessions. The key zone to watch is the 1.1500-1.1530 as a break above it can lead to a reversal up.

Spot rate: 1.1480

Relative change: -0.08%

High: 1.1502

Low: 1.1432

Main trend: Bearish

Resistance 1: 1.1500 figure and October 2, swing low

Resistance 2: 1.1530 August 23 swing low

Resistance 3: 1.1569 Sept. 28 low

Resistance 4: 1.1600 figure

Resistance 5: 1.1630 August 8 high key level

Resistance 6: 1.1654 August 27 high

Support 1: 1.1463 October 4 low

Support 2: 1.1432 current October 9 low

Support 3: 1.1400 figure

Support 4: 1.1350 figure